The twin scandals of Archegos and Greensill are drawing the attention of Switzerland's central bank. It is warning of vulnerabilities in the operative business of UBS and Credit Suisse.

Swiss policymakers have praise for the capital cushions of Switzerland's largest banks, in their annual report on the Swiss banking sector released on Thursday. While the Swiss National Bank doesn't supervise banks, it takes a close look as part of its mandate to ensure financial stability – five banks including UBS and Credit Suisse are systemically relevant in Switzerland.

The SNB singled out Archegos, over which both major Swiss banks stumbled into big losses, as illustrative of how lenders are exposed to significant risks and potentially major losses untied to macroeconomic or any system-wide financial shocks. Credit Suisse lost $5 billion in its dealings with the hedge fund and UBS more than $800 million.

Court Case With Consequences

The episode is harsher for Credit Suisse, the smaller of the two banks by market capital and by assets, because it surfaced just three weeks after the Zurich-based bank had pulled the plug on a $10.1 billion line of supply chain funds. The move set into motion the insolvency of Greensill Capital, which co-managed those funds.

Credit Suisse is the subject of three regulatory reviews – Archegos, Greensill, and a governance probe sparked by its spying on a former top executive. Its new chairman, António Horta-Osório, is leading an exhaustive review of its strategy, risk, and culture as a result.

High In Peer Comparison

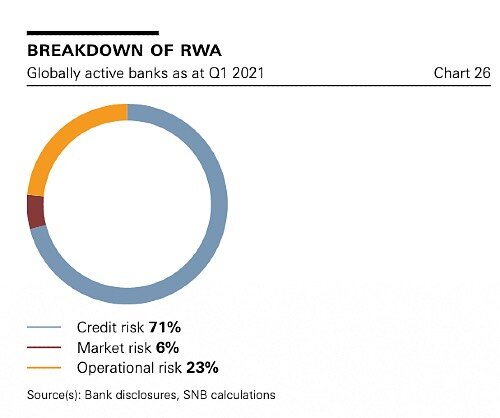

The SNB makes clear it believes both the hedge fund may beset the banks for some time to come, and Greensill in Credit Suisse's case as well. The share of risk-weighted assets stemming from operational risk at both houses – 23 percent – is already «relatively high by international standards» which average 16 percent, the central bank notes (see graph below).

This is because both institutes have a costly history of legal cases, the SNB said. Archegos as well as Greensill undoubtedly carry the threat that the trend continues. The SNB defines operational risk as any loss due to inadequate procedures, fraud, or failed internal systems – but also legal and cyber risk.

The legal risk in particular is already coming into play at Credit Suisse, which is going through the courts in a bid to recoup money that its wealthy clients lose on the funds. The specter of fraud at a major client of Greensill is also emerging. Finma, which formally supervises both banks, is investigating whether Credit Suisse's risk management failed.

Unpleasant Memories

The SNB's wording is the most specific since 2012, when it ordered Credit Suisse to curtail shareholder payouts in favor of padding its capital. The following month, the Swiss bank raised capital by issuing contingent convertible instruments to anchor investors, selling prime Zurich real estate like the Peterhof Grieder building on Paradeplatz and private equity holdings, asking staff to take more shares in place of cash bonuses, and cutting costs.

The central bank made no such directives clear in the most recent report, while signaling that it is closely monitoring the situation. For good reason: UBS' and Credit Suisse's total exposure – the sum of on- and off-balance-sheet positions as international regulatory define it – is roughly 130 percent of Switzerland's gross domestic product.