In 2020, we saw the official launch of our triReduce Benchmark Conversion functionality that facilitates the proactive reduction of exposure to legacy benchmarks. Much has been written about the future of interest rate benchmarks, but all we can say for certain is that the future is anything but.

As a number of regulators recently updated their recommendations for legacy benchmarks, TriOptima is able to support customers in transitioning their OTC swap portfolios to alternative benchmarks.

12 months ago, we began the journey to increase awareness of how triReduce’s leading multilateral compression network could form the foundation of a robust and effective conversion mechanism on to alternative benchmarks. We demonstrated the value of our existing compression activities as well as providing a window into the future where each individual party can proactively perform their transition.

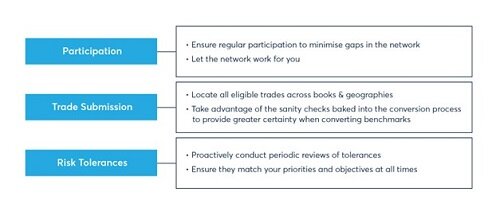

The basic tenets start with maximizing compression opportunities to remain as close to the core net risk position in legacy benchmarks. This objective can be achieved by focusing on participation, trade submission and risk tolerances.

Participation, Trade Submission and Risk Tolerances

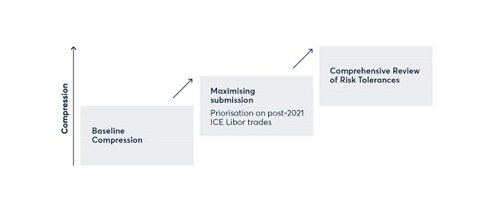

We conducted a series of coordinated simulations to demonstrate the potential in these keys areas to each customer in quantifiable terms. This included a thorough examination of their compression activity and untapped potential, which can be visualized through the reverse waterfall below.

The conversations that followed helped to shed light on the great work that was already being done; clear guidelines for how service utilization could be improved further; as well as establishing a comprehensive playbook for how to back book transition could occur with the adoption of triReduce’s Benchmark Conversion functionality.

Reverse Waterfall of Compression Potential

The Mechanism for Converting What Remains

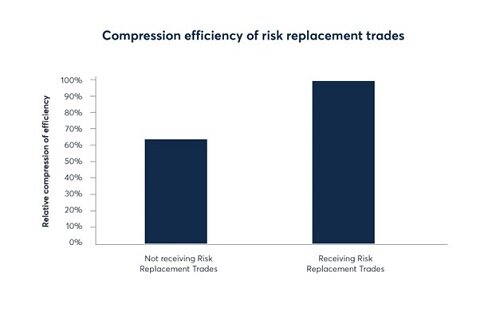

In preparation for the second part of the process, where legacy risk can be converted into the alternative benchmark, we have delivered functionality for risk replacement trades based on trade templates that have been made available by CCPs. These templates are particularly important in portfolios where insufficient volume in the alternative benchmark exists. In this case, we can use the templates to obtain valuations and risk sensitivities from each participating firm’s own mid-market curves.

In preparation for the second part of the process, where legacy risk can be converted into the alternative benchmark, we have delivered functionality for risk replacement trades based on trade templates that have been made available by CCPs. These templates are particularly important in portfolios where insufficient volume in the alternative benchmark exists. In this case, we can use the templates to obtain valuations and risk sensitivities from each participating firm’s own mid-market curves.