Singapore Moves Closer to New York

Brexit and the United States election made a dent in the new Global Financial Centres Index. Major hubs such as London and New York fell in favour dramatically, according to the latest statistics.

The Global Financial Centres Index (GFCI 21) provides profiles, rating and rankings for 88 financial centres, drawing on two separate sources of data - instrumental factors (external indices) and responses to an online survey.

Last years unpredicted events of Brexit and the U.S. election had a significant impact. London and New York fell 13 and 14 points respectively. These were the largest declines (except for Calgary) in the top 50 financial centres, according to the 21st edition of the GFCI 21, published bi-annually by the think tank Z/Yen Group.

Asian Hubs Grow Stronger

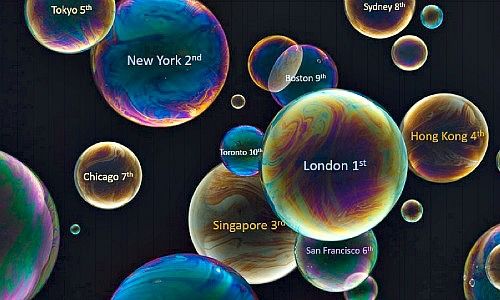

Despite the twin events, London, New York, Singapore, Hong Kong and Tokyo remain the top five financial centres. The gap between third place Singapore and second place New York continues to close.

Global Uncertainty

«We live in uncertain times and financial professionals hate uncertainty. Brexit has caused uncertainty in Europe and the election of Donald Trump has caused uncertainty globally,» said Mark Yeandle, Associate Director at the Z/Yen Group and the author of the GFCI.

Singapore rose by eight points and is now only 20 points behind New York having been 42 points behind in GFCI 20. The leading financial centres in the Asia-Pacific region rose in the GFCI ratings. Beijing in particular rose significantly and is now within the top twenty centres worldwide

Mixed Results

Offshore centres had mixed results. The British Crown Dependencies remained stable, whilst Caribbean centres had mixed fortunes with the Cayman Islands and the British Virgin Islands falling, but Bermuda and the Bahamas rising slightly.