For a long time, all things «green» were considered an idiosyncrasy of alternative types. In the meantime, however, sustainable products have become a firmly established part of everyday life – in finance too.

A growing number of private investors is taking environmental, social and ethical aspects into account when selecting their investments. According to the LGT Private Banking Report, the Germans have a particular affinity for sustainable investments.

At 39 percent, significantly more German respondents indicate that environmental aspects played a «very concrete» role in the investment decisions they made, compared to 25 percent in Austria and 22 percent in Switzerland.

Social aspects were concretely relevant for around one-quarter of participants from all three countries. And ethical aspects – for example no investments in arms, prostitution, drugs or unhealthy products such as tobacco or alcohol – were important to 52 percent of German respondents, and therefore significantly more important than for the Austrian (37 percent) and Swiss (38 percent) respondents.

Share of Sustainable Investments Rising

Around 40 percent of the high-net-worth private individuals surveyed in Austria, Germany and Switzerland are already investing in sustainable investments.

Around half have no such investments and around 10 percent indicated that they do not know if they hold any investments of this kind. Two-thirds of the participants in the study intend to keep their share of investments in sustainable investments the same in the near future, while 30 percent want to increase their share in such investments.

The Issue of Returns

While sustainable investing has already become mainstream for institutional and professional investors, the share of private investors in terms of the total volume of sustainable investments remains fairly low (see market report by Forum Nachhaltige Geldanlagen, SRI Study 2016 by Eurosif).

The reluctance of private investors in this area is often attributed to the issue of returns. In a country comparison, the results of the LGT Private Banking Report show greatly differing views in this regard.

Lower Returns?

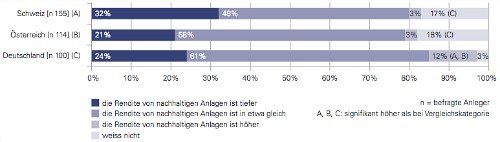

32 percent of Swiss respondents believe that returns on sustainable investments are lower than for traditional investments (Austria 21 percent, Germany 24 percent). In contrast, 12 percent of German respondents believe that returns on sustainable investments are higher than for traditional investments (Switzerland and Austria only 3 percent respectively).

If they had to choose between returns and sustainability, 52 percent of German respondents would opt for sustainability. In Austria, only 38 percent would do so, while in Switzerland, 49 percent would choose sustainability.

Sustainable Quality

Of note is that for the question regarding the compatibility of sustainability and returns, a high percentage of the people surveyed were unable to provide a response (between 3 and 18 percent). This means that transparency is of vital importance when it comes to sustainability.

In the future, financial services providers should therefore further improve how they inform investors of their sustainable offering and the opportunities that sustainable investments hold. They should also develop solutions, such as ratings, that will provide their clients with information about the sustainable quality of their investments.

Absolutely Comparable

In reality, it is not only personal values and the desire of private investors for sustainable investments that speak in favor of such investments. Numerous studies, such as the GIIN Annual Impact Investor Survey, show that the risk-adjusted returns on traditional and sustainable investments are absolutely comparable.

The LGT Private Banking Report 2016 was produced by Prof. Teodoro D. Cocca of Johannes Kepler University in Linz, and is based on a representative survey of 370 private banking clients in German-speaking countries. The full study can be downloaded or can be ordered free of charge.