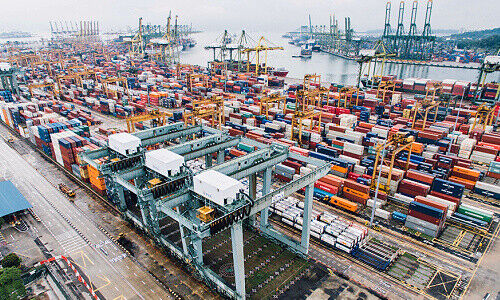

Singapore Launches Digital Supply-Chain Exchange

Singapore launched a supply chain exchange to digitize transactions in a notoriously paper-bound sector.

The exchange, called SGTraDex, is a public-private partnership, it said in a statement.

As part of the launch, it has piloted three types of situations warranting the digitalization of supply chain transactions, it indicated.

The first aims to strengthen trade flow financing by reducing the risk of fraud, the second tracks container movements, helping to alleviate congestion at ports and transport nodes, and the third digitalizes the bunkering industry, which should also help to cut financing fraud and improve the visibility of operational data.

Plug and Play

Antoine Cadoux, CEO of SGTraDex Services, said in a statement that physical paper is still customary for most supply chain transactions.

«We believe that the plug-and-play digital infrastructure we have created will go a long way to make it easy for all participants to share data under an agreed set of rules,» he added.

The platform uses distributed ledger technology to provide proof of authenticity and document origins for data exchanges, which is expected to result in significant cost savings and quicker financing by 2026.

More than 70 Participants

Singapore bank UOB plans to bring all bunker clients onto the platform by mid-2023 as a way of boosting efficiency and data security. It is the largest financier of local bunker suppliers, providing more than half of their financing.

There are already more than 70 participants on the platform, including Standard Chartered Bank, Geneva-based commodities trader Trafigura, Exxon Mobil, and Chevron.

The exchange additionally indicated it is looking at introducing green and sustainable trade financing and other capabilities in the future related to shipping, shipping supplies and spare parts.