Thomas Taw, Head of iShares Investment Strategy, Asia Pacific, at BlackRock, gives his views on the outcomes of the China bond inclusion and the implications for investors.

Following «Bloomberg»’s inclusion of RMB-denominated government and policy bank securities into the Global Aggregate Index beginning April 2019, we expect a substantive increase in passive and active flows within the local fixed income market. In 2018, foreign inflows into China’s bond market amounted to $81 billion and were largely led by central banks and sovereign wealth funds.

Moving ahead, with an estimated $2.5 trillion tracking the index foreign inflows into Chinese bonds could total $150 billion following the 20-month inclusion process – an average $7.5 billion per month. This average is likely to be unevenly distributed given that 80 percent of assets tracking the index is via active funds. Either way, 2019 is set to be another record year for foreign inflows into the China bond market.

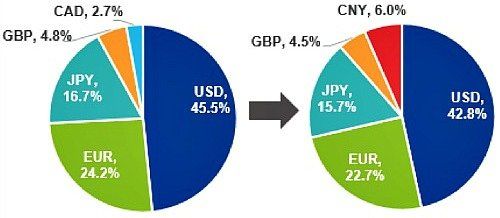

As a result of this inclusion, local currency Chinese bonds will become the 4th largest currency component comprising 6 percent of the «Bloomberg» Barclays Global Aggregate Index following inclusion. (see Chart 1)

Bloomberg Barclays Global Aggregate Bond Index

Top Five Currencies by Weighting: Pre- vs. Post-inclusion

(Chart 1. Source: Bloomberg Barclays, BlackRock, as of February 15, 2019. Chart reflects the top five constituents and does not add up to 100 percent. Post-inclusion percentages are estimates and subject to change.)

Attractive Diversification Option

In 2018, global investments into China onshore government bonds topped $70 billion, exceeding the total invested by Chinese national commercial banks. Interest in the government bond market soared among foreign investors as the share held by this segment increased from 6 percent in late April last year to 8 percent by the end of 2018.

RMB bonds are an attractive diversification option given their low correlation with global markets. In addition, RMB bonds delivered highest returns across currencies in the Global Aggregate + China index last year.

Post-Inclusion Index Weightings

Following inclusion, index weightings of securities denominated in dollar (-2.7 percent), euro (-1.5 percent), yen (-1.0 percent) and sterling (-0.3 percent) will be reduced. Outflows from index rebalancing are expected to be greatest in the listed markets above. (see Chart 1 above)

The phased, long term timeframe of inclusion should not substantially affect spot USD-CNY; near term investor focus such as U.S.-China trade talks, monetary easing measures in China and a stabilizing or softer dollar have a more meaningful impact, in our view.

In terms of policy bank bonds, inclusion could attract increased foreign investor interest due to lack of investment enthusiasm from abroad so far. In addition to inclusion into the Global Aggregate Index, RMB-denominated bonds will be eligible for inclusion in the Global Treasury and EM Local Currency Government Indices beginning in April.

Outperformance in Chinese Bonds

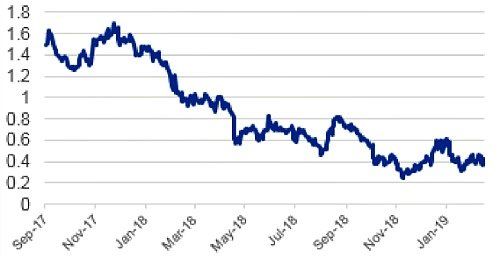

In the one year period up to February 15, China bonds within the Global Agg + China index saw the highest total returns across currencies, followed by AU$ and NZ$. Chinese debt’s narrowing yield premium to U.S. Treasuries has been significant over the past months:

Chinese 10-year government bonds yield approx. 40bps more than their U.S. equivalent, down from as high as 160-170bps towards the end of 2017 and touching just 25bps in November 2018, its narrowest spread since 2010. Chinese debt advanced even as dollar bonds drove declines in many global markets. (see Chart 2 below)

Chinese 10Y Yields vs. U.S. 10Y Treasuries

Chinese premium has shrunk significantly since 2017

(Chart 2. Source: Bloomberg, BlackRock, as of February 15, 2019)

Implications for Investors

- We see Chinese bonds as an attractive diversifier given their low correlation with global markets. Resilience in China should put a floor under the synchronized slowdown in emerging market growth.

- Weightings of securities dominated in dollar, euro, yen, and sterling will decrease as RMB becomes the 4th largest currency component comprising 6 percent of Bloomberg Barclays Global Aggregate Index.

- The long term timeframe of inclusion should not substantially impact USD-CNY, compared with other market and regulatory forces such as U.S.-China trade talks, monetary easing in China and a stabilizing dollar.

- Additional flows into China’s bond market will provide liquidity and a further boost to the local bond market, allowing foreign investors greater access in the long run.

Accessing China’s Evolving Markets Using ETFs

Exchange Traded Funds (ETF) could be a convenient way for investors to gain exposure to China’s evolving markets. The simple building block nature of an ETF allows investors to effectively diversify their existing portfolios by adding specific market and/or industry exposures. Other benefits of ETFs include:

- Transparency: ETFs are relatively straightforward and transparent in their investment objective, as well as also highly transparent in their holdings

- Accessibility: ETFs offer access to market exposure of a variety of asset classes, both broad and specific

- Liquidity: ETFs are highly liquid, and can be bought and sold during the trading day

- Cost efficiency: ETFs generally have a lower management fee compared with an active fund invested in the same market and/or assets

iShares by BlackRock

iShares unlocks opportunity across markets to meet the evolving needs of investors. With more than twenty years of experience, a global line-up of 800+ exchange traded funds (ETFs) and $1.9 trillion in assets under management as of March 31, 2019, iShares continues to drive progress for the financial industry. iShares funds are powered by the expert portfolio and risk management of BlackRock, trusted to manage more money than any other investment firm1.

1Based on $6.52 trillion in AUM as of 3/31/19

Important Disclaimers: This article is issued by BlackRock (Singapore) Limited (company registration number: 200010143N). This advertisement or publication has not been reviewed by the Monetary Authority of Singapore. In Hong Kong, this material is issued by BlackRock Asset Management North Asia Limited and has not been reviewed by the Securities and Futures Commission of Hong Kong. Investment involves risk. Past performance is not necessarily a guide to future performance. The value of investments and the income from them can fluctuate and is not guaranteed. You may not get back the amount originally invested. Changes in the rates of exchange between currencies may cause the value of investments to fluctuate. Any research in this document has been procured and may have been acted on by BlackRock for its own purpose. The results of such research are being made available only incidentally. The views expressed do not constitute investment or any other advice and are subject to change. They do not necessarily reflect the views of any company in the BlackRock Group or any part thereof and no assurances are made as to their accuracy. iShares® and BlackRock® are registered trademarks of BlackRock, Inc., or its subsidiaries in the United States and elsewhere. © 2019 BlackRock, Inc. All rights reserved. All other trademarks, service marks or registered trademarks are the property of their respective owners.