What Exactly Is a Factor?

The growing popularity of factor-based strategies begs the question: What, really, is a factor, and how can we tell how it has performed?

By Melissa R. Brown, CFA – Managing Director of Applied Research

According to Blackrock, as of June 2018, there was $1.9 trillion invested in these strategies, a figure expected to grow by nearly 80 percent to $3.4 trillion by 2022. It is clear that these strategies have moved to the forefront of investing, but is there really one «truth» about a factor?

There are numerous underlying metrics that can be used to define a given factor, and there are also a number of ways that stocks can be combined to create a portfolio on which to measure factor performance.

Portfolio Construction Differentiates the Good from the Bad

That performance may, in turn, drive a decision to invest in the factor. We have found that construction differences can lead to widely varying exposure to the intended factor as well as very different performance, even though the portfolios created have the same name!

One common definition, used in a number of Smart Beta ETFs, is to simply buy the highest-ranked stocks based on a factor. Another is to go long the most attractive stocks and short the least attractive. The biggest issue for these types of portfolios is that they may end up with big exposures to other factors, such as sectors or countries, size bets, etc.

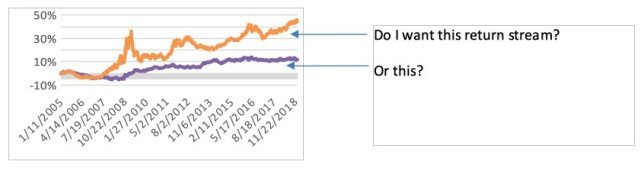

Those other bets may not be obvious to the investor, and it is difficult to disentangle the performance of the factor from these other exposures. In the chart above, much of the performance of the purple line – which represents buying the top quintile and shorting the bottom quintile on a factor – was driven by big sector underweights and overweights.

Other construction methods may be less common but are more «pure» in that the resulting portfolios are not exposed to unintended bets. Managers may use an optimizer to create a portfolio that aims to maximize factor exposure while eliminating other bets.

These portfolios may vary by investment universe, rebalance frequency, whether they are permitted to short, target levels of volatility, etc. All could reasonably be called a «factor portfolio», but they will have very different exposures to the factor and, most importantly, widely varying performance.

Testing This Theory Using Profitability

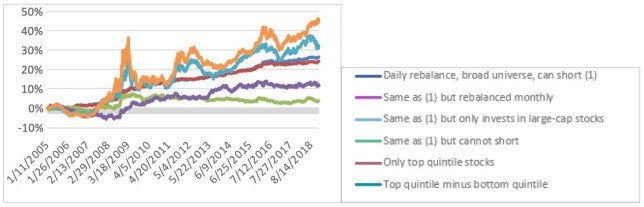

We chose a popular factor, Profitability1, and assumed investment in a broad global developed markets benchmark to illustrate this point. We created several «Profitability» portfolios, some with an optimizer and others by simply dividing the universe into quintiles based on the underlying factor.

The exhibit below illustrates the vast differences in performance across these portfolios. Clearly, the ability to short and the access to a broad investment universe made a big difference in the portfolios’ returns.

Why is This Important to Know Ex-Ante?

An investor may have chosen the portfolio that bought the top quintile and shorted the bottom because it had the best performance over this long period. But what would have happened if she invested at the peak in March 2009? She may have abandoned the strategy quickly and thus missed out on its recovery.

Alternately, if she held on, it would have taken more than nine years to make her money back. Clearly, these portfolio construction alternatives could very well have driven a decision about whether the factor will produce a desirable investment.

Conclusion: The Bottom Line

There really is no one «true» factor. Simple universe sorts may produce strong returns, but they do so with quite a bit of volatility. Constraints common to many investment managers, such as an inability to short or a requirement to limit the investment universe, can mean the difference between a successful factor and one that is much less attractive.

Just because a factor «works» in a broad universe of stocks where the manager has the ability to short and can rebalance every day does not mean that factor will work in your portfolio.

- For more analysis on this topic, please see our recent paper «What, Exactly, Is a Factor?», which you can download here.

As Managing Director of Axioma's Applied Research, Melissa Brown generates unique insights into risk trends by consolidating and analyzing the vast amount of data on market and portfolio risk maintained by Axioma. Brown’s perspectives help both clients and prospects to better understand and adapt to the constantly changing risk environment.

1 Here we define Profitability as a combination of a company’s return on equity, return on assets, cash flow to assets, cash flow to income, gross margin, and sales to assets.