Pharma Powerhouses on the Rise in East Asia

Asia’s pharmaceutical industry is rapidly evolving into a key engine of global healthcare. Nowhere is this more evident than in China, where the biotech sector’s innovative momentum has surged dramatically in recent years, opening up exciting new opportunities.

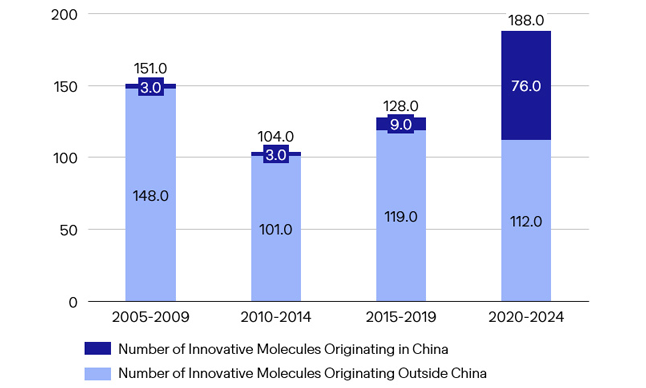

The number of novel molecules originating from China has risen sharply – clear evidence that the country has evolved from a latecomer to a serious innovator.

This innovative strength is making Chinese companies increasingly attractive to international partners. Many of the products under development have the potential to be best-in-class, are cost-efficient, and provide global pharmaceutical companies with opportunities to strengthen their own portfolios..

China's Share of Innovative Molecules in International Comparison

Click to enlarge (Source: IQVIA, Pharmcube, Bellevue Asset Management)

China’s deep pool of young, highly educated professionals is a decisive advantage, too, as it helps to accelerate drug development progress and has enabled the country to narrow the innovation gap to the West from ten to a mere four years or so. Biotech company Akeso serves as a good example here: Its flagship drug, ivonescimab, a bispecific PD-1/VEGF antibody for lung cancer, is currently in Phase III trials and could become the first in class and also best in class, with multi-billion peak sales potential.

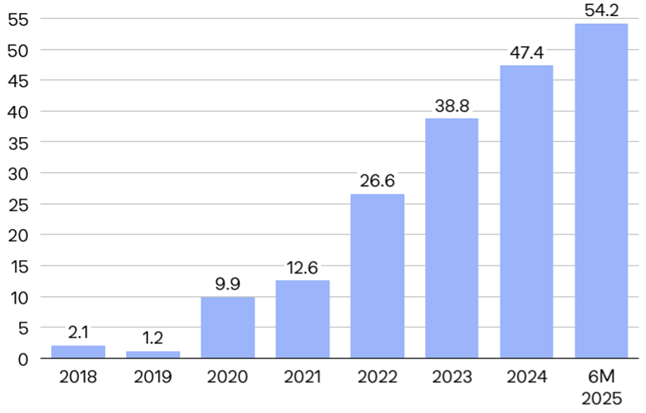

China’s Biopharma Out-Licensing Activities

In billion dollars (Source: IQVIA, Pharmcube, Bellevue Asset Management)

The Chinese healthcare market is developing very dynamically. Following the pricing reforms, growth is taking center stage, drug pipelines are strong, and new markets are being developed; sales impacted by volume-based procurement (VBP) is no longer a material concern.

China's pharmaceutical contract development and manufacturing industry (CDMOs) offers the most production capacity in the world and is now a global leader in biologics, cell, and gene therapies. Online pharmacies are rapidly gaining ground in China thanks to efficient and transparent platforms as well as government support.

Japan’s Pharma: Innovation and Strong Alliances

Japan’s pharma industry stands out for its excellence in innovation and strong partnerships with Western pharmaceutical giants. Chugai has partnered with Eli Lilly and is a leader in the GLP-1 space with orforgliprone, a weight-loss pill for patients with obesity and type 2 diabetes. Daiichi Sankyo is collaborating with AstraZeneca and has positioned itself as a specialist for antibody-drug conjugates.

It discovered Enhertu, a blockbuster drug for patients with breast cancer, and has other ADC assets in the pipeline, including lung cancer ADCs. Otsuka is working closely with Novartis and has generated steady value growth from drug licensing agreements, for example, for Kisqali in the treatment of breast cancer and Pluvicto in the treatment of prostate cancer.

A weak dollar represents an additional tailwind for East Asia’s healthcare industry. This is evident in the form of cheaper imports, which boost company income statements, and lower service costs on dollar-denominated debt. The general environment is attracting foreign investors and has enhanced company funding options.

Conclusion

China is an enticing investment proposition in view of its strong dynamics, cost advantages, and growing innovative power, while Japan stands out for its cutting-edge R&D pipelines and global partnerships. These two countries offer a strong foundation for sustained growth and have made Asia a driving force in the global pharmaceutical industry.

- Investors can tap these opportunities through our two healthcare strategies: Asia Pacific and Emerging Markets. More information about Bellevue here.

Excellence in Specialty Investments

Bellevue is a specialized asset manager listed on the SIX Swiss Exchange with core competencies covering healthcare strategies, entrepreneur strategies, and alternative and traditional investment strategies. Established in 1993, Bellevue, a House of Investment Ideas staffed by 90 professionals, generates attractive investment returns and creates value added for clients and shareholders alike. Bellevue managed 4.8 billion francs in assets as of June 30, 2025.

This document is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The information and data presented in this document are not to be considered as an offer to buy or sell or an invitation to subscribe any securities or financial instruments. The information, opinions and estimates contained in this document reflect a judgment at the original date of release and are subject to change without notice. Liability for the accuracy or completeness of all information in this document is expressly disclaimed. This information does not take into account the specific or future investment objectives, the financial or tax situation or the particular needs of any specific recipient. This document does not constitute independent investment research. Interested investors should always seek professional advice before making an investment decision. The information in this document is provided without any guarantees or warranties, for information purposes only, and is intended only for the personal use of the recipient. Every investment involves some risk, especially with regard to fluctuations in value and return. Investments in foreign currency involve the additional risk that a foreign currency might lose value against an investor's reference currency. This document does not reflect all possible risk factors associated with an investment in the aforementioned securities or financial instruments. Historical performance data and financial market scenarios are no guarantee or indicator of current and future performance. The performance data are calculated without taking account of commissions and costs that result from subscriptions and redemptions. Commissions and costs adversely affect performance. Financial transactions should only be carried out after thorough study of the current prospectus and only on the basis of the most recently published prospectus and annual or semi-annual report. Bellevue Funds (Lux) SICAV is admitted for public distribution in Switzerland. Representative in Switzerland: Waystone Fund Services (Switzerland) SA, Avenue Villamont 17, CH-1005 Lausanne. Paying agent in Switzerland: DZ PRIVATBANK (Schweiz) AG, Münsterhof 12, P.O. Box, CH-8022 Zurich. Bellevue Funds (Lux) SICAV is admitted for public distribution in Austria. Paying and information agent: Zeidler Legal Process Outsourcing Limited, 19-22 Lower Baggot Street, Dublin 2, D02 X658, Ireland. The Bellevue Funds (Lux) SICAV is admitted for public distribution in Germany. Information agent: Zeidler Legal Process Outsourcing Limited, SouthPoint, Herbert House, Harmony Row, Grand Canal Dock, Dublin 2, Ireland. Bellevue Funds (Lux) SICAV is registered in the CNMV registry of foreign collective investment schemes distributed in Spain, under registration number 938. Representative: atl Capital, Calle de Montalbán 9, ES-28014 Madrid. Prospectus, Key Investor Information Document (PRIIP-KIID), the articles of association as well as the annual and semi-annual reports of the Bellevue Funds under Luxembourg law are available free of charge from the above-mentioned representative, paying, facilities and information agents as well as from Bellevue Asset Management AG, Theaterstrasse 12, CH-8001 Zurich. With respect to fund units distributed in or from Switzerland, the place of performance and jurisdiction is established at the registered office of the representative.