Digitization: Five Types of Bank Clients

Digital or personal? These often seem like the only two options when it comes to the digitization of client-bank relationships. However, a study shows that what makes bank clients tick is more complex than that.

In the discussion surrounding digitalization in the banking segment, a distinction is often only made between those bank clients who use digital channels and want to dispense with relationship managers, and those who refuse to use these channels and favor the traditional private banking model that features personal advice.

But it’s not quite that straightforward – there are many facets in between. The LGT Private Banking Report 2018 (only in German available) identifies five different «Digitalization Types» and shows what this means for banks.

The Early Tech Adopter

Early Tech Adopters are very interested in technical innovations and enjoy trying these out. Innovative online access to a bank – around the clock and irrespective of location – as well as the possibility to interact virtually with their relationship manager is therefore important to them.

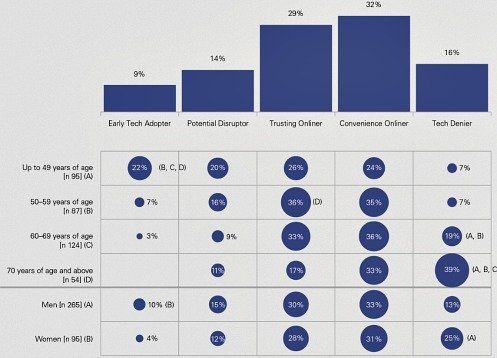

Despite this affinity for technological innovations, they do not want to dispense with a personal relationship manager or their bank. Nine percent of the high-net-worth private investors from Germany, Austria and Switzerland who participated in the LGT Private Banking Report survey fall under this type of bank client. This category consists mostly of younger (<49 years of age) and male respondents.

The Potential Disruptor

Potential Disruptors are being driven away from the traditional banking relationship and toward purely online providers not so much because of their curiosity about technology, but more due to a certain amount of skepticism vis-à-vis banks and relationship managers (14 percent of respondents).

If they could, this client type would dispense entirely with their bank and relationship manager and conduct their banking business only digitally. Among Potential Disruptors, there is therefore a strong tendency to move away from traditional private banking and toward online banking – for traditional banks, this translates into a high risk of these clients migrating elsewhere.

The Trusting Onliner

Trusting Onliners only use online solutions when these have become established and have a proven track record – and once this is the case, online solutions become their preference. This group trusts online channels and can imagine interacting with its bank and relationship manager primarily virtually.

The Trusting Onliner is quite neutral about personal advisory services and does not assign any particular value to them. Of the respondents to the LGT Private Banking report, 29 percent fall under this client type.

The Convenience Onliner

The largest share of respondents – 32 percent – is Convenience Onliners. They want to benefit equally from both – online access and personal advisory services. They are very strongly oriented toward relationship managers and highly appreciate the direct, personal discussions they have with them.

Online communication and interaction is still, however, seen as necessary and useful. Innovation is not very important to them in this area. They are called Convenience Onliners because the convenience of interactions with the bank is particularly important to them.

The Tech Denier

Sixteen percent of respondents completely reject virtual interaction with their bank – they are the Tech Deniers. The Tech Denier is skeptical and sees major risks and dangers in using technological tools. The possibilities offered by social media are something they do not even want to acquaint themselves with.

If possible, they avoid online channels entirely. They want to stick to the traditional, personal contact with their bank and relationship manager. This client type is usually seen among older (>60 years of age) and female respondents.

(n = 360 investors surveyed in Switzerand, Germany and Austria)

What Does This Mean For Traditional Private Banking?

If their respective needs are met, the Early Tech Adopter, the Convenience Onliner and the Tech Denier (accounting for a total of 57 percent of respondents) are expected to remain faithful to the traditional private banking model in the future, because they appreciate their personal relationship with the bank and relationship manager. The Potential Disruptor (14 percent of respondents), in contrast, shows a higher likelihood of deciding against a traditional private banking relationship in the future and opting for purely virtual offerings instead.

They appear to already be «lost» when it comes to a traditional banking relationship. Not so the Trusting Onliners (29 percent of respondents). They prefer online channels only once they are truly established; but also don’t assign particularly high value to personal advisory services. Time will tell which direction they will tend to go in – toward purely digital advisory models or personal advisory services with digital tools.

Leave it up to the Client

If banks want to keep the Trusting Onliners as clients, they must create a suitable environment for this large client group in order to strengthen customer loyalty.

No matter which way you look at it, a multi-channel offering appears to be inevitable for banks. To continue to serve clients optimally in the future, they must offer a broader range of offline and online possibilities and services and then leave it up to the client to decide if and which thereof they want to use. Because the desire for digitalization is not just black or white, but has many facets.

The LGT Private Banking Report has been conducted on behalf of LGT every two years since 2010 with the objective of gaining important insights into the investment behavior and the attitudes of private banking clients. Around 360 high-net-worth private individuals with disposable investment capital of over 500,000 or over 900,000 francs are surveyed to this end. The surveys are conducted by renowned market research institutions. The author of this representative scientific study is Professor Teodoro D. Cocca of Johannes Kepler University Linz in Austria.