finews.asia Releases 2024 Private Banking AUM League Table

Asia’s top private banks posted a second consecutive year of growth in assets under management to reach a record-high of over $2 trillion in 2024, according to finews.asia's annual Private Banking AUM League Table.

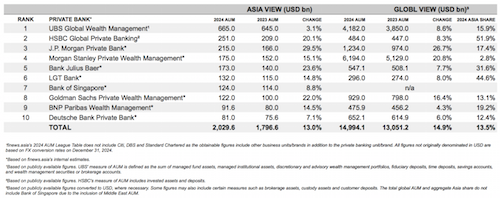

Assets under management (AUM) at Asia’s top 10 private banks rose 13 percent year-on-year to an all-time high of more than $2 trillion at the end of last year, according to finews.asia's 2024 Private Banking AUM League Table. This marks the second consecutive year of growth following a 21.3 percent increase in 2023 with Swiss behemoth UBS Global Wealth Management once again taking the lead at $665 billion, up 3.1 percent.

Aside from fresh assets, investment returns were a major driver. Outside of home markets where Asian investors have traditionally held a strong bias, the US is known to be the favored market with significant demand in the technology sector, most notably due to optimism in artificial intelligence.

US equities delivered an outstanding 2024 with the S&P 500 soaring 25 percent and the Magnificent Seven – Apple, Nvidia, Microsoft, Alphabet, Amazon, Meta and Tesla – seeing an average gain of over 60 percent.

American Exceptionalism

Exceptional performance in American stock markets was mirrored by exceptional growth at American private banks.

J.P. Morgan Private Bank posted Asia’s largest AUM increase of 29.5 percent, or $49 billion, to hit $215 billion. Together with Morgan Stanley Private Wealth Management (15.1 percent increase to $175 billion) and Goldman Sachs Private Wealth Management (22 percent increase to $122 billion), the US trio were all among the top five in 2024 by AUM growth.

HSBC: More Swing Than Pivot

At HSBC, Asia has accounted for an increasingly larger share of private banking assets every year, demonstrating consistency in its pivot to the region. In 2024, that pivot looked more like a swing as Asia now makes up 51.9 percent of global AUM, up from 46.8 percent in 2023.

At $42 billion, HSBC Global Private Banking saw the second largest addition of AUM, which included $18 billion of net new invested assets. In an interview in February, Asia private banking head Lok Yim attributed the inflows to the onshore businesses in mainland China, Taiwan and India, alongside the offshore centers of Hong Kong and Singapore, in what he called «a year of productivity and optimization».

Julius Baer: Rebounding With a Vengeance

After a meagrely 3.7 percent uptick in 2023 and a 15.1 percent drop in 2022, Julius Baer – Asia’s largest pure-play in the top 10 rankings – rebounded with a vengeance, boosting its regional AUM by 23.6 percent, or $33 billion, to $173 billion.

According to the bank’s financial results, it saw net new money inflows of 14.2 billion Swiss francs ($16.5 billion) in 2024 with strong contributions in key strategic markets including Singapore, Hong Kong and India, where it owns an onshore unit led by CEO Umang Papneja, ex-chief investment officer of major local player IIFL Wealth Management.

Has Asia’s AUM Share Bottomed?

While often called a growth market, Asia is interestingly accounting for a lower and lower share of global AUM in recent years amongst industry leaders.

In 2021, the region made up 17.3 percent of worldwide assets at the top 10 private banks before gradually trending downwards. At 13.5 percent in 2024, this trajectory saw its smallest year-on-year dip compared to 13.8 percent in 2023. Could this be the bottom? Time will tell but it is worth noting that all but two private banks saw a higher share of global assets attributable to Asia.

See finews.asia’s 2024 Private Banking AUM League Table below.

(click on the table to enlarge)