Clients Trust Their Relationship Managers

Almost half of high net worth investors feel their knowledge of investment matters is on a par with their relationship manager – but they are nevertheless satisfied with the service provided by their advisors.

Financial markets are a science in their own right. Maintaining perspective and an overview in the labyrinth of investment vehicles and unpredictable, volatile stock markets is often difficult for private investors. The high net worth private investors surveyed for the LGT Private Banking Report 2016, however, clearly not only have basic knowledge, but are highly informed about investment matters.

At between 40 and 50 percent, a significant share of respondents are of the opinion that their relationship manager – who is generally understood to be an expert in terms of investing – does not have more knowledge than they do in this area. The German respondents in particular consider their knowledge of investment matters to be high – significantly higher than the Swiss and Austrians (see below).

Many Make Decisions Without Relationship Manager

Accordingly, it is no surprise that between 40 and 60 percent of respondents indicate that they sometimes make investment decisions without their relationship manager. This does not, however, mean that high net worth investors generally think little of their relationship managers – on the contrary.

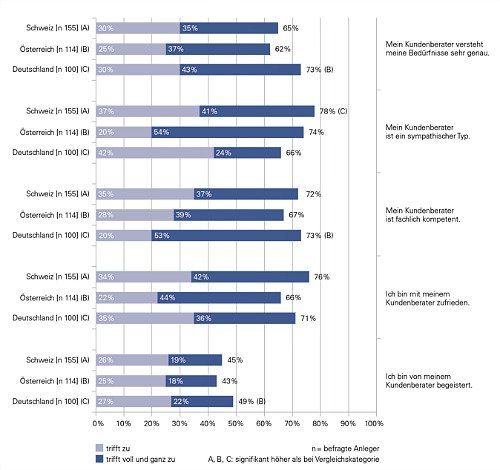

The evaluations of relationship managers are extremely positive – in all areas, be it in terms of likeability, professional expertise or the question of whether the relationship manager understands the needs of the client. Around 70 percent of respondents are satisfied with their relationship manager. Between 43 and 49 percent are enthusiastic about them (see below).

Thirteen percent of Swiss, 19 percent of Austrians and 9 percent of Germans have such a close relationship with their relationship manager that should the latter change employer, the respondent would go with them to the new bank.

Money-at-risk, which is calculated using these figures and which multiplies the probability of a change of bank with the share of assets withdrawn is 7 percent in Switzerland, 10 percent in Austria and 9 percent in Germany.

Goal: Better Investment Returns

What clients expect from the advisory services they receive is hardly surprising: the most important need in terms of advice is and remains achieving better returns, followed by advice that ensures discretion, and transparent and comprehensible advice. Some sobering news for the banks: in the eyes of their clients, this need for performance tends to be insufficiently met.

There is potential for improvement in this area. Otherwise, clients could begin to entertain the idea of becoming even more autonomous in their investment decisions and involving their relationship manager even less in the future, despite the fact they generally appreciate the service provided by their relationship managers.