Why Whiskey and Wine Are Becoming Stronger Bets Than Real Estate

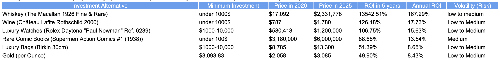

A recent study by Dubai-based Falcon Funded analyzed and revealed alternative investments showing strong growth from 2020 to 2025, comparing them against Manhattan real estate prices, per square foot.

The study of prop trading firm Falcon Funded evaluates each asset class based on price changes, return on investment (ROI), annual ROI, and volatility, excluding transaction fees, taxes, or storage costs.

Real estate, with its stable price growth, serves as the benchmark for comparison. The research highlights emerging investment categories that have gained traction among investors over the past five years.

Leading the Pack

(Click to enlarge)

Leading the pack, whiskey, specifically the Macallan 1926 Fine & Rare, has delivered 13,542.51 percent ROI from 2020 to 2025. Starting at $17,092 in 2020, the value of the bottle skyrocketed to $2,331,778 by 2025, yielding 167.29 percent annual ROI. This market has proven to be an ultra-low-risk investment with staggering returns, leaving traditional real estate in the dust.

Wine comes second with a 126.18 percent ROI, increasing from $787 in 2020 to $1,780 in 2025. With a 17.73 percent annual ROI, wine presents a safer, more stable option compared to cryptocurrencies and NFTs, which are far more volatile. While not as high-growth as whiskey, wine is a steady performer in the alternative asset market.

Luxury Watches place third, offering a 106.75 percent ROI, from $580,413 in 2020 to $1,200,000 in 2025. With a 15.63 percent annual ROI, luxury watches offer reliable returns and less volatility than cryptocurrencies or NFTs. The market for luxury watches provides strong growth and lower risk than assets like Bitcoin, making it a stable investment.

Rare Comic Books, such as Superman Action Comics #1, rank fourth, with an 88.68 percent ROI, increasing from $3,180,000 in 2020 to $6,000,000 by 2025. Their 13.54 percent annual ROI positions them as a stable, cultural asset that grows over time, similar to luxury watches. While comic books provide impressive returns, their growth isn’t as rapid as whiskey or Bitcoin.

Luxury bags, particularly Birkin 30cm, come in fifth, with a 51.39 percent ROI, moving from $8,785 in 2020 to $13,300 in 2025. At an 8.65 percent annual ROI, luxury bags provide modest returns with relatively low risk. They aren’t as high-performing as whiskey or luxury watches but remain a steady and dependable investment.

Gold holds the sixth spot, showing a 49.90 percent ROI, from $3,093.83 per ounce in 2020 to $3,085 in 2025. Its 8.43 percent annual ROI is stable but lags behind other alternatives like whiskey or cryptocurrency. While gold offers less volatility than NFTs or Bitcoin, its slower growth makes it a less attractive option for investors seeking higher returns.

«The growing interest in these non-traditional investments highlights a shift in how investors are looking to balance risk with growth potential. With real estate showing slower growth, alternative markets are quickly becoming the go-to choice for savvy investors seeking more dynamic opportunities,» a spokesperson of Falcon Funded said.