Vontobel: Solving Social and Environmental Problems with Impact Investing

Investing and generating a financial return while at the same time solving the world’s social and environmental problems sounds appealing to investors. Of key importance is the ability to measure the resulting effect.

By Dan Scott, Deputy CIO Vontobel Wealth Management, based in Zurich

In 2007, the Rockefeller Foundation coined the term «impact investing.» As distinguished from philanthropy, the credo of impact investing is to achieve a positive social or environmental impact and earn money while doing so.

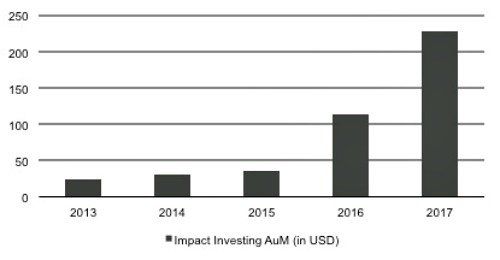

Concretely, impact investors, working via private equity or private debt, engage in companies or projects that provide market-driven, scalable business models that improve the quality of life of disadvantaged people in areas such as clean drinking water, quality education and healthcare services, and clean energy – and thereby generate financial returns. The market volume of impact investing reached billion dollar in 2017.1

Massive Increase in Impact Investing

(in Billion of Dollar)

Measurement Increases Both Transparency and Confidence

One of the success factors of impact investing, in addition to achieving an attractive financial return, is the consistent and verifiable measurement of its positive environmental or social effects, for example, the number of students with access to affordable and high-quality medical education or the number of people with access to affordable solar power1.

Accordingly, GIIN has created a standardized catalog of key figures for better comparability of companies within a specific sector or region, which rating agencies such as «B Analytics» have begun to use to develop a rating system.

When companies consistently pursue their impact goals and apply effective standard tools to report in detail on the positive impact generated by the products and services they produce, it clearly contributes to greater transparency and accountability, and also increases investor confidence.

Great Potential for Foundations...

Foundations that fulfill a social or environmental purpose and have a long-term investment horizon are tailor-made for impact investing. For example, it is not necessarily required that their investments yield a market return.

In many cases, they also have a high degree of investment flexibility when it comes to their engagements, meaning that they can seize the opportunity to advance the impact investing approach by evaluating not only returns and risk but also social and environmental impact before making any decision to invest.

...and Among Millennials

In addition, when it comes to the Millennials we can observe investment behavior that has changed. They are globally networked and have a sharper sense of awareness than previous generations of the need to care for the global common good.

Millennials are therefore more apt to put their money to use to achieve a positive social and environmental impact than simply to maximize returns.

1 Global Impact Investing Network (GIIN)