Emerging Market Corporate Bonds Entail Less Risk

Old stock market adages are popular with investors – including the assumption that emerging market corporate bonds represent risky terrain and are therefore best avoided. However, this is a misconception.

By Wouter van Overfelt, Senior Portfolio Manager, Vontobel Asset Management

The prejudices against this asset class – especially among international investors – becomes apparent if you consider that dedicated emerging market corporate bond funds account for only a very small proportion of the total volume of asset classes. According to an estimate based on data from J.P. Morgan, these investment vehicles contain a mere $95 billion of assets, while the asset class as a whole grew to $2,164 billion in recent years (status as of November 2018).

In other words: Around 95 percent of outstanding emerging market corporate bonds are held by non-specialist investors. However, the limited degree of investment knowledge among this group opens up a large playing field for experienced active investors as a result of market efficiencies and widespread behavioral patterns – creating opportunities to realize attractive yields.

Wide Spreads and Short Duration

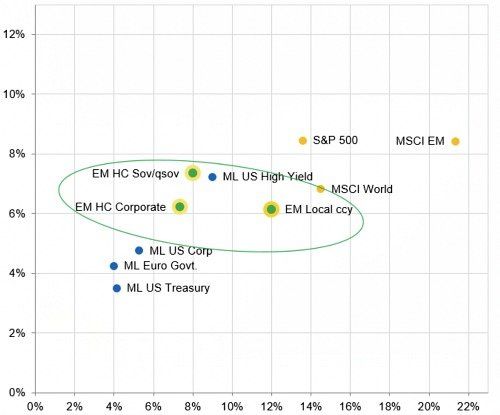

And there is no shortage of opportunities. Risks are also not in short supply but they take a different form to what is widely assumed. Unlike other common asset classes, emerging market corporate bonds perform well on a risk/return scale – ranking somewhere between the bonds of developed countries and global equities (see chart).

Within the bond investment segment, emerging market corporate bonds stand out due to their comparatively wide spreads and short duration. Compared to a US investment grade corporate bond, for example, the spreads of emerging market bonds are around three times wider, while the duration is significantly shorter.

Performance of Emerging Market Corporate Bonds

(Period: June 2003 – February 2019. Historical performance is no indication of current or future performance, source: Bloomberg)

What many find surprising is the fact that emerging market corporate bonds are less volatile than government bonds in hard currencies, which are a favorite among emerging market investors (see chart). There are three reasons for this.

More Broadly Diversified

First, benchmark indices for emerging market corporate bonds are much more broadly diversified due to the large number of different issuers, which far exceeds the number of countries included in the usual government bond benchmarks – be it in local or hard currencies. For example, the benchmark for emerging market government bonds in hard currencies (EMB) comprises 167 different country issuers, and the benchmark for emerging market government bonds in local currencies (GBI EM) consists of only 19.

In contrast, the J.P. Morgan Corporate Emerging Markets Bonds Index (CEMBI) encompasses 651 companies across 50 countries. The number of issuers alone allows investors to achieve broader portfolio diversification without any one issuer being assigned an overly large weighting. This is particularly beneficial during periods of market volatility when portfolios that are invested in government bonds have to cope with more fluctuations in prices.

Longer Maturity

Second, emerging market government bonds have, on average, a longer maturity than corporate bonds, which is accompanied by a longer duration – a feature underestimated by many in terms of risk. Investors tend to be less concerned about defaults in the case of emerging market government bonds, meaning that national governments are able to issue bonds with a longer maturity.

However, this exposes investors to higher interest rate risks. The longer the maturity of a bond, the more sensitive it is to changes in key interest rates. If the interest rate rises during a bond’s time to maturity, the price of the bond decreases and this can impact on the yield for the investor (if the bond is not held until maturity). Hence, changes in interest rates result in price volatility.

Higher Rating Quality

Third, the benchmark indices for emerging market corporate bonds display a higher rating quality than the equivalent benchmark indices for government bonds. This is due to the fact that emerging markets can issue bonds relatively easily – whatever the quality of the country – thanks to their sovereign powers, while a comparatively smaller number of emerging markets have companies of the necessary quality to be able to raise capital in the public markets.

This results in government bond benchmarks whose quality is impacted by frontier countries, resulting in a higher overall rating for corporate bond indices. Portfolios consisting of government bonds in hard currencies, therefore, tend to contain more low-quality countries whose bonds may experience larger price fluctuations in periods of market stress.

Misconceptions About Default Risks

There are also misconceptions about default risks among investors: While there are real default risks in the case of emerging market corporate bonds, they are often evaluated incorrectly. Compared to developed countries, developing economies often display a similar frequency of payment defaults for the last decade.

However, an even more decisive factor is that in emerging markets, the consequences for bondholders are often less serious, since the number of company insolvencies is around 25 percent lower than for developed countries. As a result, there is more room for negotiation for bondholders and recovery rates are higher. Missed interest payments or payments of principal are the main reasons for defaults among emerging market corporate bonds.

Country Rating

These missed payments often trigger rating downgrades, although this is another area in which specific features of the asset class need to be considered since ratings in developing countries don’t have the same significance as in industrialized nations. It should be noted that company ratings in emerging markets are capped by the overarching country rating.

It is very rare for a company to achieve a higher rating than that of the country in which it is domiciled. Hence, a company with a B rating in a country with a B rating represents a potentially very attractive investment opportunity, while a B rating in an industrialized nation will not necessarily earn any applause.

Limited Picture

Furthermore, ratings present only a limited picture of the creditworthiness of a company. They simply quantify the probability of default but they do not take account of the loss given default or, in the reverse scenario, the recovery rate.

In fact, the recovery rate may even be higher than the traded price of a bond that is already in default. This could be the case, for example, if the company is willing to negotiate and adopts a constructive position vis-à-vis bondholders. Specific situations such as these can offer significant potential yields for investors.

Very Attractive Sources

A deep understanding of the type of risks inherent in emerging market corporate bonds and how they can be communicated to investors in regular key performance indicators can help emerging markets investors to gain a better insight into this asset class, which includes very attractive sources of yields based on valuation discrepancies and event-driven situations.

The opinions expressed here represent the personal views of the author. It should not be assumed that they represent the views of Vontobel Asset Management.