EY’s 2019 Global Wealth Management Research focused on assessing exactly that.

By Mark Wightman and Boudewijn Chalmers, EY Wealth and Asset Management APAC Advisory

One-third of clients plan to switch wealth management providers over the next three years. What can wealth management firms do about it?

EY research shows that the most profitable clients are often the least loyal and most likely to switch. Notable is that the global average of clients planning to switch in the next three years is the same as the number of clients that moved assets in the last three years. However, in Asia-Pacific (APAC), the number of clients that have shifted assets in the past 3 years is significantly lower (15 percent) than the global average, but it is expecting a strong increase in the next three years to 35 percent.

More Likely to Switch

An interesting observation is that older APAC clients are more likely to switch providers, whereas, at a global level, the youngest client groups are more likely to switch. Overall, this is a very interesting finding for the region and perhaps highlights the greater scrutiny that older (more sophisticated) clients place on their wealth management providers, and the opportunity to embed greater loyalty among younger (less likely to switch) clients.

Older, richer clients are more demanding of their wealth advisors, so we are not surprised there is higher propensity to switch in the future. And in some countries, these clients are figuring out that they aren’t getting enough value from the advisors, and are open to finding someone else who can provide value in line with their expectations.

Clients Want a Multidimensional Relationship

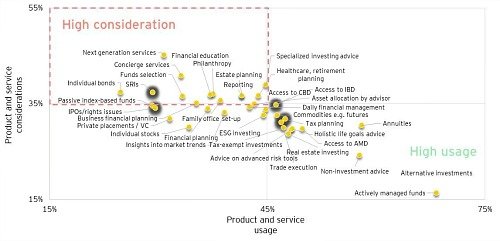

In fact, clients are not thinking in terms of products anymore. Clients place a very high value on a wide range of attributes. Other attributes beyond product and price like advisory capabilities, quality and reputation, technology and personal attention, are rated at least as important. This indicates that wealth clients want a deeper, multidimensional relationship with their wealth managers.

(Source: EY 2019 Global Wealth Management Research)

Wealth management clients are expressing an increasing interest in next-gen services, socially responsible investing, philanthropy, estate planning, and education. A clear observation from the research is that clients do not specifically reference the need for products and that they are more thinking in terms of solutions and services.

First Generation Digital Channels Are Getting Pushed to the Side

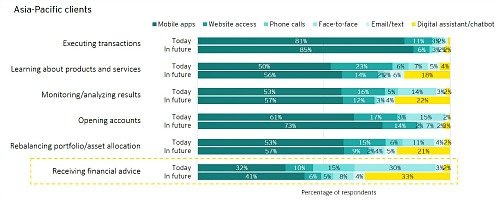

Client preferences are rapidly changing toward digital channels and voice-enabled assistants – not just for basic, transactional activities, but for managing wealth and receiving financial advice as well. The research shows that the value of digital channels increases with an increase in the level of investable assets.

APAC clients anticipate adopting digital assistants to receive financial advice over the next three years. Firms will need to reconfigure their digital delivery model to meet these expectations.

(Source: EY 2019 Global Wealth Management Research)

The research identified that future demand for digital assistants is the greatest when seeking financial advice and learning about products and services, and less for basic, repeatable activities. This is very interesting considering it to be the area where today advisors are expected to deliver most of their value-add in the client relationships.

Very Interesting Development

A clear observation is the stronger preference for mobile applications as preferred interaction channel today than was expected when forecasting in 2016 (18 percent expected with 55 percent being current reality). With a stronger growth expected over the next three years to over 60 percent of clients see mobile as their primary interaction channel.

Interesting to see is the strong reduction in face to face being the primary channel with a projected 4 percent seeing this as the primary engagement channel by 2022. This is a very interesting development considering that in countries like Australia most financial advice is delivered face to face today

The Role of Human Advisers Is Changing

So, will digital assistants replace financial advisors in the future? We see a future where financial advice is delivered predominantly through apps, chatbots, and digital assistants, with very few human advisors required to provide the bulk of the advice. However, there will always be complex client questions that need to be services. So high-end, high-touch customized services for those requiring estate planning, tax, trust & other advice delivered through human advisers will remain.

In general, it is clear to say that digital channels are expected to be the primary modes of engagement for most services provided by a wealth manager.

Pricing Models Are Changing Rapidly

Many clients do not trust they are charged fairly; firms must better demonstrate value with greater transparency and choice.

In an industry built around trust and adding value to client relationships, there exists a fundamental challenge as wealth managers seem to struggle to differentiate and communicate value to clients. The fact that there is a significant portion of clients who struggle to understand how much they pay and are concerned about hidden costs, doesn’t help.

Dissatisfaction Among Clients

In APAC, the awareness around this is different by country/region, i.e., in Australia, awareness of fees is higher than in any other country/region, while in Singapore and Hong Kong, the levels of understanding of fees seem significantly lower. This could be due to the transactional or embedded fee models that exist there and varying levels of mandatory transparency.

The dissatisfaction among clients regarding how they pay is driving the preference for simplified price structures. A majority of clients indicated a desire to change the way they pay for financial advice, with older and wealthier clients more likely to desire a change. Though no one fee method is predominantly preferred, clients are showing a preference for fees that are more predictable, such as payment per hour of support and fixed fees.

Going to Subscription Models

We also expect to see more firms going the path of subscription models. Most recently, the market saw broker Charles Schwab introducing such a model for its financial planning services — a monthly subscription, irrespective of AUM or frequency of usage.

- The EY 2019 Global Wealth Management Research Report is a survey across all wealth segments globally. Find out more insights here.

The views reflected in this article are the views of the authors and do not necessarily reflect the views of the global EY organization or its member firms.