Nothing is likely to preoccupy investors more this year than the corona crisis. Its repercussions will probably be similarly massive to those of the 2008 financial crisis. A study shows what high-net-worth investors learned back then and how they are dealing with the corona crisis.

Around 37 percent of the Swiss private banking clients expect the corona crisis to be less severe than the 2008 financial crisis, and 60 percent indicate that the corona crisis is not leading to concern about their assets.

These are some of the findings of the recently published LGT Private Banking Report. Are investors taking the current crisis seriously enough?

Crises Give Rise to Fears

«If investors made adjustments to their portfolios during the corona-related market turbulence between February and April 2020, then it was generally to take advantage of attractive prices. Panic-driven purchases did not materialize,» says Finance Professor Teodoro D. Cocca of Johannes Kepler University in Linz, who led the study. LGT can confirm this finding.

«To invest successfully during this kind of crisis, short-term tactical asset allocation is just as important as strategic long-term allocation. We want to facilitate a perfect interplay between these two strategies so that investors can navigate safely through turbulent times and take advantage of short-term opportunities,» says Heinrich Henckel, CEO LGT Bank Switzerland.

Cash or Gold For a Short Time

A long-term comparison shows that investors likely follow exactly this strategy and generally do not let crises change their course. If they do, then they only flee to cash or gold for a short time.

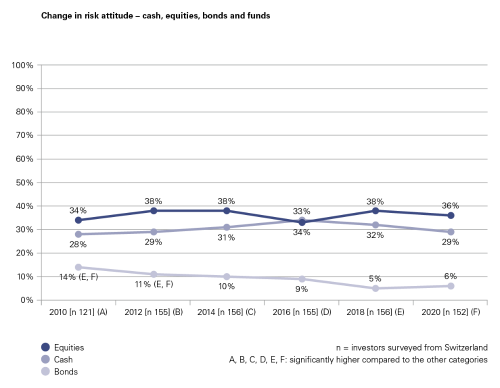

For example, since 2010, the share of cash in portfolios has been between 28 percent and 34 percent, and, depending on the stock market situation, has fluctuated in the reverse direction to the share of equities held in portfolios, which has ranged between 33 percent and 38 percent (see figure 1).

(Over the past ten years, the share of cash in portfolios has fluctuated between 28 percent and 34 percent, depending on the stock market situation, and has shown an opposite trend to the share of equities.)

This seemingly deliberate and non-emotional reaction could also be an important lesson taken from the last financial crisis. Due to their experiences during that time, a good two-thirds of the respondents want to reach their investment decisions based on facts. In addition, 63 percent now increasingly avoid investments they do not understand.

Clients Who Are Too Independent Are «at Risk»

One of the results thereof is that portfolios are not diversified enough. Even 12 years after the financial crisis, investors primarily invest in equities, bonds and cash. Alternative investments such as private equity, which they could use to further optimize diversification, remain relatively underused.

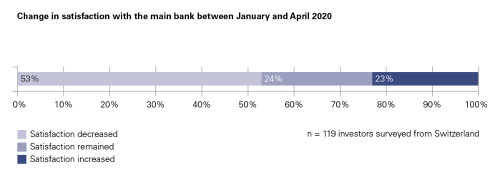

A further consequence of the 2008 financial crisis is the increased skepticism towards banks and relationship managers. Although confidence in and satisfaction with banks had returned during the years that followed, these were once again put to the test during the corona crisis (see figure 2).

(In the Corona crisis, confidence in and satisfaction with the banks were put to the test: Around 50 percent of the investors are less satisfied with their main bank compared to the beginning of the year. The banks were only able to score points with just over a quarter of the investors during this period.)

From the perspective of the banks, investors who make their own investment decisions and without a relationship manager are therefore particularly «at risk» of changing institutions. These clients are already more critical vis-à-vis the banks and relationship managers and for exactly 60 percent thereof, satisfaction with their bank and relationship manager decreased between January and April 2020.

Critical Attitude

These so-called Soloists today account for 41 percent of the private banking clients surveyed. «The more critical attitude resulting from the experience of the crisis has led this segment of investors to stop relying on the banks and make their investment decisions autonomously. This trend appears irreversible,» says Cocca.

However, for the majority of the investors, personal investment advice remains indispensable, even 12 years after the financial crisis. At the beginning of 2020, 42 percent of the high-net-worth investors made their investment decisions together with their relationship manager or fully delegated such decision-making to their bank.

Demand For Advisory

Only around one-fifth of the respondents is considering whether a relationship manager is actually needed. «Noteworthy is the fact that demand for advisory services remains high even 12 years after the financial crisis, despite the technological advancements,» says Cocca.

These findings support LGT’s assessment that digitalization cannot replace personal advisory services. «Our clients very much appreciate the interaction with their relationship managers, especially when it comes to making the right investment decisions in difficult times,» says Henckel.

Under the leadership of Professor Teodoro D. Cocca, the Department of Asset Management at Johannes Kepler University in Linz in January and February 2020 conducted the sixth survey since 2010 on the investment behavior of private banking clients in Germany, Austria and Switzerland as part of the LGT Private Banking Report.

A total of 358 individuals were surveyed. The main criterion for participation in the survey was the disposable investment capital. In Germany and Austria, the minimum disposable investment capital was 500,000 euros and for Switzerland, it was 900,000 francs. Due to the effects of the corona pandemic on financial markets, a follow-up survey was conducted in April 2020 with the private banking clients in Switzerland who had already been surveyed in January by the LINK Institute.