The business consultancy finalix shows how financial services advisory teams can harness Artificial Intelligence to enhance customer experiences, streamline decision-making, strengthen Know Your Customer processes, and achieve better overall results. While this transformation takes time, even initial use cases reveal substantial potential.

Our well-structured processes in wealth and asset management are, in essence, data processing frameworks where data is turned into insights and value for our customers.

However, while we have traditionally been good at processing structured information automatically, we, as humans, face challenges in keeping up with the volume of unstructured information coming our way and turning all our available data into personalized and relevant insights and value for our customers.

This is one of the domains where AI can shine! To make this more tangible, let’s look at two example use cases:

Near-Real-Time Research Data Augmentation

While real-time is not as relevant in wealth and asset management as in other domains, using AI to effectively analyze vast amounts of market data quickly to augment and enrich in-house research for faster, more informed decision-making, is a key differentiator.

By automating the ingestion of news feeds and performing near-real-time financial, market, and sentiment analysis, AI provides near-real-time market alerts (e.g. sell signals) that empower advisors to react swiftly and make relevant and value-adding decisions.

AI/ML Supported KYC

KYC processes are highly complex since financial institutions need to combine structured, unstructured, relational, and transactional data into a single holistic customer view to be able to assess risk, preferably on an ongoing basis.

While structural and transactional data monitoring is comparatively simple to do, linking unstructured data such as client notes and documents, and also third-party data from various sources is complex. However, this is precisely where AI systems and natural language processing (NLP) excel.

When combined with graphing technology, they can help provide a single holistic view of the customer, significantly reducing both risk and effort.

Personalization: The Future Of Financial Advice

One of the most exciting applications of AI in financial services is its ability to offer hyper-personalized communication. AI pre-generated reports, video proposals, and personalized reasoning go beyond traditional methods, enabling deeper client engagement and empowering customer-facing staff to be more effective and provide a more tailored service.

By pairing AI avatars and automated content generation with real human interaction (hybrid advice), financial institutions can scale personalized service without compromising quality.

The AI And Data Maturity Framework

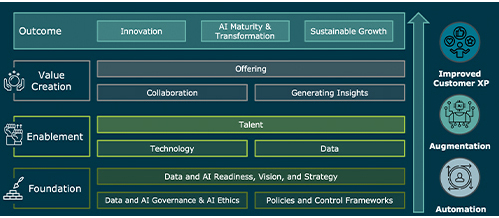

At the core of successful AI adoption lies the finalix AI and Data Maturity Framework

(Source: finalix AI and Data Maturity Framework)

This framework outlines four critical stages:

- Foundation: Establishing data governance and AI ethics through robust control

frameworks and policies. - Enablement: Building the technological and data infrastructure while developing talent within the organization.

- Value Creation: Generating insights, fostering innovation, and augmenting human efforts through AI-driven processes.

- Outcome: Delivering sustainable growth by enhancing automation and customer experience.

Why AI Matters For Financial Services

AI isn't just about cutting-edge technology – it's about improving the core value proposition of financial advisory services.

By optimizing operations, reducing human errors, and enhancing the customer experience, AI paves the way for a more efficient and competitive advisory landscape.

Embrace The Future Of Financial Advisory With AI

The integration of AI into financial advisory services is no longer a question of «if» but «when» and «how». AI has the potential to transform the value chain by optimizing processes, enhancing customer experiences, and enabling hyper-personalized engagement. Don’t wait for competitors to leapfrog you - start exploring how AI can elevate your advisory services today.

Reach out to our SME, Andrew Rufener (This email address is being protected from spambots. You need JavaScript enabled to view it.) to learn how we can assist your journey toward unlocking the full potential of AI in your organization.

Let’s shape the future of financial advisory together!