LGT – The Most Asian of Liechtenstein's Banks

LGT will conclude the acquisition of ABN Amro’s private-banking operations in Asia by the summer. The bank will have more assets under management in the region than it has at home.

There are private banks, which count Asia as their second home market – such as Julius Baer. And then there is LGT, where Asia is about to overtake the home market in terms of size.

The Asian unit of LGT will have the company’s biggest share of assets under management by the summer, the bank said at its annual press conference on Monday. That’s after the conclusion of the takeover of ABN Amro’s Asian private bank, expected for the second quarter.

Massive Asian Boost

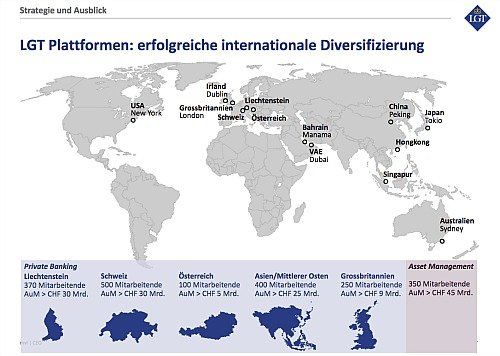

The bank of the Prince of Liechtenstein expects to get about 20 billion Swiss francs in assets under management and more than 300 employees through the acquisition. LGT currently has assets totaling 30 billion, which it manages with the help of 400 staff (see table below).

LGT in Liechtenstein has about 30 billion in assets under management and 370 private-banking staff. In neighboring Switzerland, the bank has a similar amount to take care of and 500 bankers. The bank in total managed 152 billion in assets with the help of 2,632 employees by the end of 2016.

LGT agreed to take over the private-banking activities of ABN Amro in Asia in December of last year.

The Princely DNA

The Liechtenstein-based bank landed a major coup with the transaction, with several rivals also eyeing up the attractive unit. With the takeover, LGT has won the right to call itself the fastest-growing private bank in Asia – while the No. 1 and 3, UBS and Credit Suisse (CS), are facing a slowdown of growth.

The massive takeover presents the company with the tricky challenge of becoming more Asian, but not an Asian bank. The DNA of a bank belonging to the Prince of Liechtenstein is an important marketing tool in the region.

Going Back to Colonial Days

The ABN Amro unit with its 300 bankers has deep roots in the region. The company has done business in Asia for more than two centuries, beginning at a time when Indonesia was still considered a Dutch colony.

Sources close to the bank say that the integration is taking shape. More than 90 percent of ABN Amro’s relationship managers have signed up with LGT. For the staff at ABN Amro it may seem preferable to work for a private bank such as LGT instead of for a big universal banks such as ABN Amro. The takeover thus may be seen as akin to an ‘upgrade’.

Swiss rivals won’t like much what they see – given their own hopes to get the ABN Amro unit. Rumors had it that Asia’s Bank of Singapore was interested, but also Zurich-based Julius Baer.