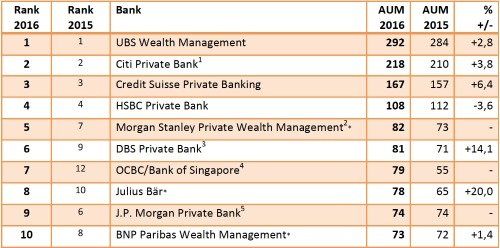

The Largest Wealth Managers in Asia: AUM Table 2016

The Year of The Monkey proved to be an eventful one for the wealth management industry in Asia. Some banks voluntary left the region for commercial reasons, while others were unceremoniously thrown out.

Despite the lethargic Chinese economy and a number of significant geopolitical events, the majority of wealth managers in Asia added to assets under management during 2016.

The pace of maturity in the Asian wealth management market quickened in 2016 with several wealth managers deciding they did not have the scale, the appetite or pockets deep enough to continue subsidizing loss making units in the hope of one day winning a bigger slice of Asian riches.

Two Distinct Strategies

Rising regulatory requirements did not help their business cases.

Those who are in for the long term however have decided on two distinct strategies: Some bulked up by ingesting rival business units in the region, while others tried the organic route adding relationship managers and other wealth structuring specialists.

Assets Under Management in Asia Pacific 2016 (US$ Billion)

Switzerland’s UBS (US$ 292 billion, +2.8%) retained its dominant position as the largest wealth manager in Asia last year. But has dropped behind growth expectations. The Swiss banking giant faces a tough time ahead expanding its wealth management business further.

It comes as little surprise then that its management is mulling to also offer its services to the affluent customers, people with less than one million dollars on their accounts.

The first runner-up Citi Private Bank (US$ 218 billion, +3.8%) has been focusing on its digital offer in 2016 and fared comparably well against the background of a demanding environment.

The second runner-up Credit Suisse (US$ 167 billion, +6.4%), much-maligned at home and with a massive loss for 2016 to its book, did rather well in Asia, recording the biggest increase in new money of most companies. The Zurich-based bank made numerous hires in the region to support its private banking business and added another country, Thailand, to its Asian wealth management stable.

Major M&A Moves During 2016

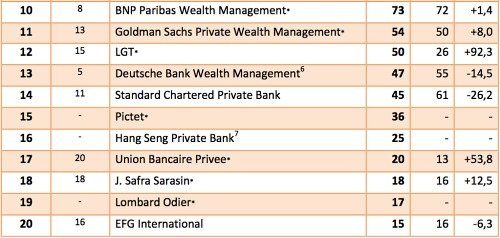

(The figure for Lombard Odier is an estimate; the bank is not publishing any regional Assets under Management.)

Singapore based DBS and OCBC’s private banking arm, Bank of Singapore, both scored with major M&A moves during 2016.

DBS surprised the market in late October 2016 after agreeing a deal with antipodean lender ANZ for the Melbourne based bank’s wealth management and retail banking businesses in Singapore, Hong Kong, China, Taiwan and Indonesia.

While in November 2016 Bank of Singapore completed its acquisition of the wealth and investment management business of Britain’s Barclays Wealth in Singapore and Hong Kong from the retreating U.K. bank.

Businesses Closed

However the domestic Asian wealth managers didn’t have it all their own way: Union Bancaire Privee (UBP) acquired the Coutts Asian units while Liechtenstein’s LGT Bank swooped in to pick up the private banking business of ABN Amro, as another European lender decided the fight for assets was not a viable one for them.

EFG International picked up what was left from Banca della Svizzera Italiana (BSI) following the closure of the business in Singapore due to the Malaysian sovereign wealth fund 1MDB scandal. Falcon Private Bank was also shuttered in Singapore for its own 1MDB misdeeds.

Julius Baer, the bank which calls Asia its second home, added headcount across its business in both Singapore and Hong Kong and is continuing to do so. British listed Standard Chartered and the family owned wealth managers Pictet, J. Safra Sarasin and Lombard Odier also added personnel for growth.

Rise of Chinese Wealth

There is no doubt that China’s largest banks are now managing substantial assets.

Four of the country's top five banks namely, Industrial and Commercial Bank of China (ICBC), China Construction Bank (CBC), Agricultural Bank of China (ABC) and Bank of China (BOC) are the largest in the world by assets, according to a ranking by S&P Global Market Intelligence. For the purpose of this table however our findings are based on established global wealth institutions outside of China.

With Chinese banks expanding internationally there is no doubt they will soon feature in the upcoming tables. To date they have not entered the race to buy any of the established wealth managers who departed Asia preferring alliances, however we expect this to change soon.