Tokenization is said to make art investments more democratic and accessible. Finews.art editor-in-chief Simone Töllner interviewed Fatmire Bekiri, who heads the Tokenization Department at Swiss Sygnum Bank.

Fatmire Bekiri is passionately dedicated to the topic of tokenization. In her role at Sygnum Bank, she has played a significant role in building and establishing this new area.

World's First Tokenized Artworks

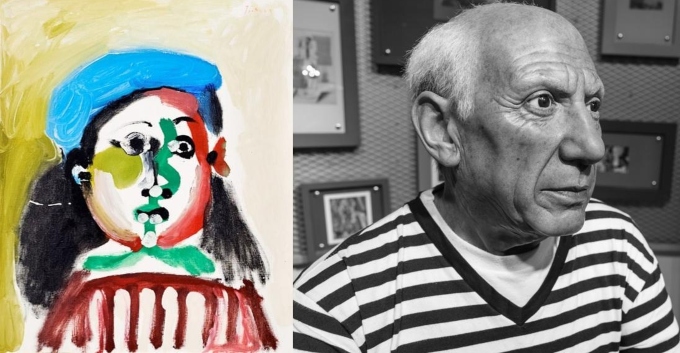

Bekiri thrives on challenges, which led her to Sygnum. Under her leadership, the bank became the first in the world to tokenize artworks, starting with the Picasso painting «Fillette au béret» (1964).

It was the first time a Picasso painting was tokenized by a regulated bank. Since the investment began in October 2021, it has generated a total return of about 20 percent for more than 60 token holders. The project partner was Artemundi. Together with Sygnum Bank, they set new standards for art investments.

Picasso's Work «Fillette au béret» and the Artist Himself (Image: Shutterstock & ChatGPT)

Other projects followed, such as the NFT of the Blue-Chip Cryptopunks #6808 in 2021 and the tokenization of Andy Warhol's «Four Marilyns» in 2022.

These initial steps in the world of digital art investments laid the foundation for further projects.

Without Expensive Intermediaries

Javier Lumbreras, CEO of Artemundi, emphasizes the importance of tokenization in the art trade: «Through quality, provenance, condition, and pricing, the fractional ownership of artworks via blockchain perfects ownership without costly intermediaries.»

Bekiri herself stated at the conclusion of the investment cycle of this Art Security Token: «The sale of 'Fillette au béret,' the first Picasso painting tokenized by a regulated bank, makes the benefits of tokenization tangible for token holders. These include unique art investments and portfolio diversification with the potential for significant returns.»

How It Works

The tokenization and fractionalization of artworks work by dividing a physical artwork into digital shares, called tokens. These tokens represent fractional ownership of the artwork, allowing investors to acquire shares in valuable artworks with smaller amounts of money.

Sygnum Bank uses blockchain technology to securely manage and trade these tokens. Each token is legally recognized as a security, ensuring the integrity and security of the investment.

Investment Case and Exit Strategy

Bekiri further explains: «It made sense to start with a Picasso painting because everyone knows Picasso. Art needs to be made accessible to people. Tokenizing young artists is certainly also meaningful, but the addressable market is smaller. It is important to find the right approach to attract investors. Renowned high-class artworks are suitable for this.»

She adds that the challenge lies in generating an investment case that defines how long one wants to own the asset and what the exit plan is. Either one sells on a secondary market or through an auction to create the opportunity to liquidate the investment and participate in the appreciation. «All these factors need to be considered to make the process successful,» emphasizes Bekiri.

Enjoying a Cigar

«We had to ensure that all contingencies were covered,» Bekiri further explains. «From what-if scenarios regarding offers for the underlying asset to minority rights clauses and forced transfer regulations. With the first complete investments on the blockchain, we demonstrated that tokenization works and trust can be built.»

Bekiri is not only a driving force in the world of tokenization but also enjoys the finer things in life. In the interview, she reveals that she likes to enjoy a good drink with a cigar, preferably a Cohiba.

Bekiri at the Client Event «Art Masterpieces on the Blockchain in Zurich». In the Background - Cryptopunk #6808 (Image: Sygnum)

Shining Eyes

It is important to her to remain authentic and stand behind the things she does, she says. When she talks about tokenization, her eyes light up—especially in combination with art projects that give her a real connection to art.

Her role also led her to the Art Basel for the first time two years ago, where she was inspired by new art projects.

Investing in Small Shares

Why art? For her, it was obvious to start with the tokenization of artworks because they are hard to access and fractionalization makes sense.

«If someone has a wealth of 10 million [dollars], they wouldn't invest it all in a Picasso painting,» she explains. However, fractionalization makes it possible, even for wealthy individuals, to invest in a specific artwork without putting everything on one card.

Overcoming Challenges

The technical and legal implementation of such projects poses a challenge. Sygnum uses powerful, immutable blockchain technology to securely store information about transactions. Tokenized artworks are professionally stored, often in duty-free warehouses, to ensure the highest security standards.

Fatmire Bekiri holds a degree in Banking & Finance from the University of Zurich. She began her career in corporate finance at IFBC in Zurich, where she worked for several years. She then moved to Aargauische Kantonalbank (AKB), where she worked in the competence center for credit in the corporate client business. After almost a year at AKB, she sought a new challenge and decided to join Sygnum Bank. There, she heads the Tokenization Department.