The Banker No One Saw Coming

Julius Baer has appointed a 50-year-old Swiss wealth manager as its new CEO, delivering one of the biggest surprises of 2024. The selection of Stefan Bollinger might turn out to be a stroke of luck for the Zurich-based private bank.

Many names were floated as potential successors to Philipp Rickenbacher as CEO of Julius Baer. Among them were Ralph Hamers, Giorgio Pradelli, and Annabel Spring. A co-leadership between interim CEO Nic Dreckmann and CFO Evie Kostakis was also prematurely deemed a done deal.

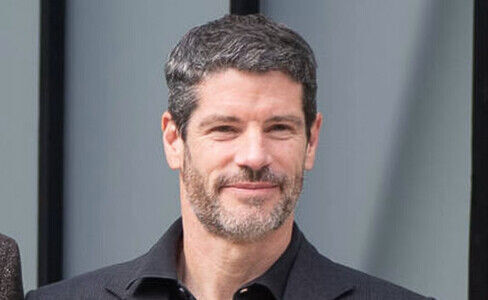

In the end, it was Stefan Bollinger, born in 1974 and co-head of private wealth management EMEA at Goldman Sachs in London, who secured the role. He will assume his new position on 9 January 2025.

Similar to Boris Collardi

The media was quick to label Bollinger a «no name.» However, Julius Baer has navigated similar scenarios before.

A comparable case occurred in 2009 when the bank introduced Boris Collardi as its new CEO. At the time, Collardi was just 39 years old and had been COO at Julius Baer for three years. Prior to that, he worked at Credit Suisse, including as an assistant to Oswald Grübel.

Steered Safely Through Financial Storms

Collardi, however, did not lack confidence or ambition.

During his tenure, he shifted the Asia business operations from Zurich to Singapore, led Julius Baer’s acquisition of Merrill Lynch’s international wealth management business in 2012, and steered the bank through tax disputes with the U.S. and Germany.

Even the NZZ had to acknowledge his «unexpectedly strong talent for dealing with demanding clients.»

Benko Debacle Weighs Heavily

Today, Julius Baer stands in a markedly different position. Even so, Bollinger will need both confidence and determination in equal measure. The private bank is still grappling with the fallout from its disastrous dealings with failed Austrian investor René Benko. The debacle cost Julius Baer 600 million Swiss francs ($665 million) in write-offs and a significant loss of trust.

Colleagues who have worked with Bollinger describe him as exceptionally personable.

Rebuilding Trust Among Clients

Unlike many of his high-profile competitors for the CEO role, he comes with a clean slate.

For a storied financial institution in need of rejuvenation and a boost in client confidence, this might be just the right starting point.