Are you looking for a one-stop-shop to set up investment ideas? «You deliver the alpha, we take care of the rest,» Vontobel's Long Lee says.

By Long Lee, Head Financial Products Asia of Vontobel Investment Banking

Are you keen to set up a strategy to implement your investment ideas and convictions? Are you looking for a one-stop-shop to set up investment ideas?

Do you prefer to focus on your investment, rather than on reporting and administrative works? Are you looking for a quick time-to-market solution? The solution is right in front of you: a Strategic Index Certificate also known as Actively Managed Certificates (AMC)

Fast and Cost-Effective Securitizations

Most of us come across an investment note, or structured note, as an investment product with a well-defined formula payoff. Strategic Index Certificate (SIC) add an active management element to the structure. SIC is a tracker certificate that offers the opportunity to participate in the performance of a strategy determined by an investment manager, the Index Sponsor (IS).

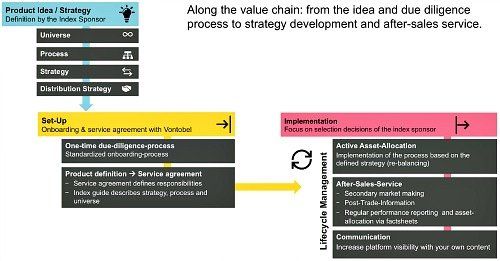

The strategy performance is tracked by calculating the value of an index that consists of individual notional strategy components which are actively selected and adjusted according to investment mandate specified by the IS, charged with fees and costs. This setup enables individualized, fast and cost-effective securitizations of an investment strategy e.g. multi-asset classes, equities, fixed income and can be structured as a rule-based strategy or a discretionary mandate.

Quick And Easy to Start

For example, as a seasoned External Asset Manager (EAM) you have come up with a brilliant investment idea linked to the Olympics, but you need a setup that is quick and easy to start, with access to multiple markets such as equities, FX and structured products. The SIC setup checks all these boxes.

Here is another example: In addition to investment themes, you are seeing more and more requests for your discretionary services, but all the new businesses come with the luxury problem of having a scalable platform for execution, daily reporting, independent valuation, etc. Again, SIC is your solution as these administrative tasks are outsourced to a 3rd party, usually the issuer of the SIC. In a basic setup, the note issuer is responsible for issuing the certificate. Certificates represent a counterparty risk. Depending on the credit rating of the issuer, there is also the possibility of third-party collateral to reduce the issuer risk.

Administrative Tasks Outsourced

Related companies of the issuer will normally perform the role of Paying, Exercise, and Calculation Agents of the certificate. Administrative tasks are generally outsourced to the same related companies, for example, provision of a term sheet, daily factsheet, KIIDs, rebalancing tool, market making in a listed secondary market.

When it comes to the core of the SIC, the index sponsor, usually a regulated asset management company, is primarily responsible for designing, defining and formulating the underlying strategy of the index, defining the components of the index in accordance with the index rules and to modify them from time to time.

More Time For Clients – Focus on Performance

Time is of essence to all of us, and especially to investment managers that assume dual client-facing as well as investment decision-making roles. SIC provides a platform for broad market access, the delegation of administrative tasks, visibility of investment management competence, flexible and transparent fee structure.

Finding the right provider of SIC is the key. Our existing SIC business is substantial and represents an important part of our activities. Every SIC is one of a kind. With our extensive experience, we can offer solutions corresponding to your individual needs. You deliver the alpha, we take care of the rest.