While strolling through any Chinese city, you will see electric vehicles navigating up and down the streets. Chinese drivers buy more electric vehicles than those of any other country.

By Dan Scott, Deputy CIO Vontobel Wealth Management, based in Zurich

They have become a rather frequent sight: shiny e-vehicles, purring along the side streets off Zurich’s Bahnhofstrasse or Geneva’s Rue du Rhône. As their streets sport more and more charging stations for electric vehicles (EVs), one might easily think the developed countries are far ahead when it comes to technological innovations.

Yet a few thousand miles away, developing countries like China have gained momentum. While strolling through any Chinese city, you will see EVs navigating up and down the streets. Chinese drivers buy more electric vehicles than those of any other country.

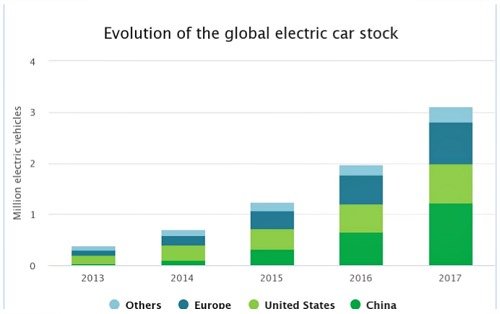

In 2017, China accounted for 40 percent of the world’s EVs on the road, compared to just over 10 percent in 2013, according to data from the International Energy Agency (IEA).

Global Electric Vehicles in Use Exceeded 3 million in 2017

(Source: International Energy Agency)

According to the IEA, global e-vehicle sales soared 54 percent to 1.1 million in 2017, with China accounting for nearly half these. This trend resulted in a global EV car stock exceeding 3 million in 2017, with China in the lead, accounting for 1.23 million.

The U.S. and EU roads sported 760,000 and 820,000, respectively. (See table above) E-vehicles accounted for 2.2 percent of the total Chinese market, while the U.S. market share in 2017 was just 1.2 percent.

The IEA includes both battery EVs (BEVs) and plug-in hybrid EVs (PHEVs) in its definition of EVs. In 2018, global EV sales reached around 2 million and are forecast to continue to climb to 2.8 million this year, a report released by ResearchAndMarkets showed. China was behind 1.1 million of these sales.

Strong Demand for E-Buses and E-Two-Wheelers

Yet e-mobility is not limited to cars alone. In 2018, the stock of electric buses rose to 425,000, a significant increase from 370,000 in 2017, according to figures from BloombergNEF. China’s e-bus fleet amounted to 421,000 compared to 2,250 in Europe and a mere 300 in the US! The number of electric two-wheelers now exceeds 300 million on the roads, confirming that e-mobility is available to every budget.

The electrification of these modes of transport has been driven by China, which accounts for more than 99 percent of both electric bus and two-wheeler stocks. Students on the way to class or Alibaba’s Taobao deliverymen – all swoosh around on electrically-powered bicycles in China.

China’s Ambition to Become the Detroit of E-Mobility

Why the sudden increase in e-mobility? The most important force behind this is clearly the Chinese government, which is aiming at 7 million vehicles by 2025. Not only is China suffering under heavy pollution, but it is also enormously dependent on imported oil, something which is perceived as a strategic vulnerability among party officials.

The lower emission of air pollutants is one of the main drivers of interest in e-mobility in countries such as China, where concerns about air quality are rising. This is why the government earlier offered a tax rebate of around 10 percent to purchasers of e-vehicles. Stricter emission regulations and targets for lower-emission vehicle registrations are additional incentives to switch.

National Ban

The Chinese government has, however, since March 2019 scaled back its subsidies on EVs with a range of less than 300 km and announced plans to phase them out completely after 2020. China will nevertheless remain the global market leader, with a market share of 58 percent, according to ResearchAndMarkets.

Beyond these reasons, in 2017 China also announced plans to impose a national ban on the production and sale of cars running on gasoline and diesel fuel (although not specifying details about the time horizon). The island province of Hainan, with a population surpassing 9 million, has moved ahead and banned the sale of diesel and petrol cars as of March 1, 2019. It is the first ban of its kind in China.

Critical Supply Agreement

In line with this is Beijing’s ambition to dominate the global battery market. Batteries are a critical success factor for e-mobility, currently comprising up to half of the total cost of the vehicle. In light of this, China invested over 80 billion dollars in 2017 in projects related to assuring the supply of the raw materials needed in battery production.

According to AFP, China now controls 80 percent of the world’s refining capacity for cobalt, a sought-after core ingredient. The country has also secured critical supply agreements with commodity giant Glencore and has aggressively pursued deals with Australian lithium mines.

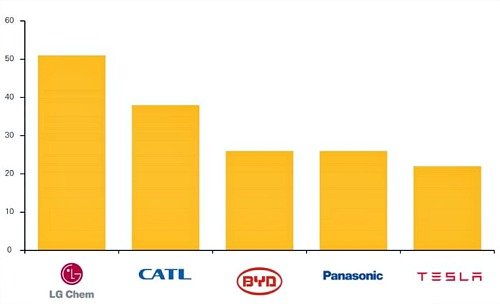

China’s determination to dominate in batteries also implies challenges for its foreign competitors. Beijing has been eager to keep those companies at bay by means of licensing or compulsory partnerships in the past. BMW, Volkswagen, and Hyundai are strongly encouraged to equip their Chinese-made electric vehicles with lithium-ion batteries supplied by CATL, China’s fastest-growing battery maker. CATL recently announced plans to build a factory in Germany that will supply BMW as of 2022, and another one in Guangzhou in China.

Largest Lithium-Ion Battery Makers by Capacity in 2018 (in GWh)

(Source: Benchmark Mineral Intelligence)

The aggressive Chinese policy is also eating away at the South Korean and Japanese reputation of being the world’s top destinations for e-vehicle batteries, including producers like Panasonic and Samsung.

By 2020, mass production of lithium-ion batteries will be concentrated in just four countries with China in the lead with an annual production of 108 GWh and a market share of 62 percent, followed by the U.S. (38 GWh, 22 percent market share), South Korea (23 GWh, 13 percent market share) and Poland (5 GWh, 3 percent market share), according to estimates by Benchmark Mineral Intelligence.

Growing Skepticism

With many countries trying to reduce their carbon footprint and foster green innovation, we are likely to observe a further rise in glossy e-vehicles humming along the likes of the Rue du Rhône. Many carmakers are already offering incentives to trade in your old gas-guzzling car for an e-fueled one.

The German and U.K. stance on diesel engines has motivated many consumers to consider alternatives. Other countries are likely to follow. Growing skepticism whether Tesla can keep its promises offers momentum for others.

Despite Tesla

In the coming years, carmakers will all face one challenge, namely, how to reduce CO2 emissions further. While emissions of EVs are lower than those of regular diesel or gasoline cars, a general «decarbonization plan» and improvements in renewable energy will still be needed to bolster the attractiveness of electric vehicles in the future.

It will be interesting to see whether those cars then will be powered with batteries originating from China, or whether Western countries will have been able to catch up. Europe currently only accounts for one percent of global production. The U.S. also remains marginal, despite the Tesla Gigafactory 1 located in Nevada, of which Panasonic is a shareholder.