CME: The Return of Travel Could Drive Oil in 2021

Heading into 2021, the path of COVID-19 appears to be a primary driver of oil prices, relegating some important fundamentals to a secondary role.

By Blu Putnam, Chief Economist, CME Group

U.S. shale production may shrink further in 2021 so long as WTI crude oil prices hover around U.S. Dollar 40/barrel.

Libyan and Iranian production is increasing. Saudi Arabia and Russia are maintaining production discipline. All these are critical supply factors to consider.

Can Transportation Rebound?

Yet, the primary driver for oil in 2021 may well be the path of the virus and how it influences the transportation industry, especially airlines. Jet fuel is a meaningful component of oil demand in its refined state, and airline travel remains severely constrained in countries where the virus has not been well contained.

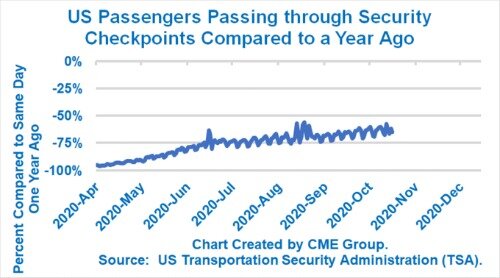

As 2020 draws to a close, another wave of the virus appears to be keeping U.S. domestic travel demand severely dampened. The number of passengers flowing through TSA security checkpoints each day has flat-lined at levels about 60 percent below pre-pandemic numbers.

The picture is the same in Europe, where travel among countries is highly constrained.

China is the only outlier. The virus hit China first. However, China was also the first country to make solid progress in containing the domestic spread of the virus. Chinese domestic air travel is now almost 90 percent back to pre-pandemic levels.

International air travel has not started to recover anywhere, as most countries still impose quarantine restrictions on arriving passengers, and there are very few flights anyway.

Less Business Travel Expected

Even when a vaccine arrives and progress is made globally in containing the virus, business travel may take years to recover to pre-pandemic levels. Work from home and virtual meetings have taken over the business world. Companies are planning for considerably less business travel than in the pre-pandemic world, even when health fears recede, and travel restrictions disappear.

The collision of the virus’ influence on-demand with complex supply fundamentals may make for a volatile year for oil prices. The path of the virus may determine the broad trend, up or down, from a demand perspective, while the ebbs and flows of supply surprises around the world may generate substantial noise.

Inform Your Thinking About Global Markets – Subscribe here.

Bluford «Blu» Putnam has served as Managing Director and Chief Economist of CME Group since May 2011. He is responsible for leading economic analysis on global financial markets by identifying emerging trends, evaluating economic factors and forecasting their impact on CME Group and the company's business strategy. He also serves as CME Group's spokesperson on global economic conditions and manages external research initiatives.