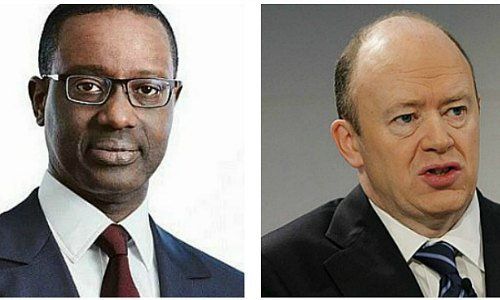

Tidjane Thiam vs. John Cryan: Contest of Losers

Tidjane Thiam and John Cryan, the CEOs of Credit Suisse and Deutsche Bank, are competing in the fine art of crisis management. Thiam currently has the edge over his rival, finews.asia believes.

The once proud banking giants of Switzerland and Germany, Credit Suisse (CS) and Deutsche Bank, together seem to edge ever closer to the quagmire – at least that’s what their respective share prices suggest. Since Tidjane Thiam and John Cryan have taken the reigns, the CS stock gave way to the tune of 63 percent and Deutsche by 64 percent.

Thiam and Cryan took over with the declared aim to turn the tide. After a few weeks of getting to know their banks, both presented a restructuring plan. Things seem to have gotten worse ever since.

The Most Riskiest Banks

The International Monetary Fund (IMF) named Deutsche Bank the most dangerous banking institute in the world at the end of June. CS followed on the marginally better third place in the «Financial Assessment Program» of banks carrying the greatest risk for the financial system.

Despite massive job cuts and harsh cost reductions, both CS and Deutsche only just managed to return a profit in the second quarter. Net income of 170 million francs and 20 million euros were qualified as accidental by analysts.

Joint Disgrace

Both CEOs were unlucky in as much as market conditions didn’t help their restructuring efforts. Cryan and Thiam were both forced to assure the public that their banks were «rock solid» and «outstandingly capitalized» in light of worries about liquidity in the European banking industry – assessments evidently not shared by investors.

Then came the joint disgrace of last week: the stocks of CS and Deutsche were kicked out of the Stoxx 50 benchmark, with effect of yesterday.

Cryan took further flak after his bank was one of the ten worst amid 51 institutes put under the stress test.

Not So Bad After All?

Drawing parallels isn’t much surprising as both Thiam’s as well as Cryan’s predecessor failed to prepare their banks for the changes in regulation and capital requirements.

Both banks were groaning under the weight of oversized investment banks and risk-laden balance sheets with too little own capital.

Markets and investors seem to assess condition and positioning of the two banks similarly, that’s at least what can be deduced from the respective valuations. Looking at it more closely however would suggest that this is not justified.

Judging from a number of criteria and key figures, Thiam is in a better position with CS than Cryan with Deutsche, one year after their take over, finews.asia believes.

1. Equity

The core capital ratio of CS was 11.8 percent at the end of the second quarter. Not brilliant, but an improvement by 40 basis points over the course of the reporting period.

The same figure at Deutsche Bank was 10.8 percent, down 30 basis points from the end of 2015. This makes it increasingly difficult for Deutsche to reach its medium-term target of 12.5 percent.

Thiam is more modest with his target of 11 to 12 percent.

2. Balance Sheet Risks

Deutsche’s investment bank is a heavyweight compared with CS’. This fact is being mirrored by the risk-weighed assets, which measure up to 271 billion francs at CS and a whopping 403 billion euros at the German institute.

CS has reduced risks on its balance sheet while Deutsche witnessed a slight increase in the first half of 2016.

3. Sources of Income

Under the guidance of Brady Dougan, CS had started shifting the center of gravity away from the investment bank toward wealth management. The respective importance under Thiam’s guidance has further shifted: investment banking contributes only 39 percent of revenue, while the majority of revenue is being generated by corporate and private banking as well as asset management. Under Dougan, the figures were the opposite still.

Not so at Deutsche: investment banking remains a revenue generator according to Cryan’s strategy and contributes some 63 percent of the total. That makes Deutsche Bank much more vulnerable to turbulences on the markets, which are likely to continue for a while yet.

4. Private Banking

Credit Suisse has reinforced private banking across the bank in line with the change in weight of investment banking discussed under point 3. It is beneficial judging from a sustainability point of view, because revenue from wealth management is more stable and less prone to swings than from securities trading.

Deutsche still sees itself as a trader, even if Cryan aims to strengthen wealth management within the bank. Thiam, who strives for the same, has a stronger base to build upon.

Assets under management in private banking total 690 billion francs at CS and 310 billion euros at Deutsche.

5. Asia

Looking for growth opportunities had Thiam and Cryan turning their attention to Asia – with CS enjoying an advantage there too. CS is one of the leading investment banks and one of the top 3 private banks.

The $50 billion gap between CS and Deutsche in assets under management is significant. The entrepreneur bank strategy is helping CS to profit much more from synergies with the investment bank than Deutsche Bank and is better positioned to exploit its growth potential.