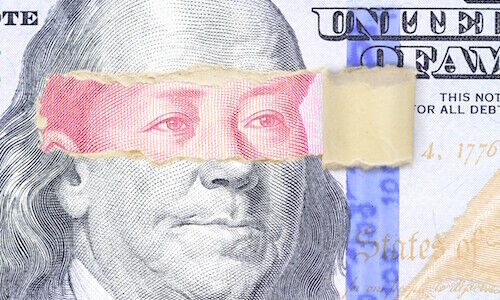

Will China Weaponize Its US Treasury Holding?

Amid the rapidly escalating trade war, some onlookers are speculating that Beijing could retaliate by dumping its giant US Treasury holding. Private banks sound off on the prospect of a mass sell-off by China and beyond.

Based on official figures, China is the second largest holder of American government debt, also known as US Treasury bonds, at $761 billion, as of January 2025, behind Japan’s holding of more than $1 trillion. Some estimate the actual figure is as high as approximately $1 trillion when accounting for unknown sums held in custody accounts in Europe.

Given the significant amount, China has the potential ability to destabilize the Treasury market and drive US borrowing costs higher as a response to recent trade war escalation that has seen US tariffs on Chinese imports soar to 145 percent.

Divided on Dumping

According to multiple private banks, the view is divided on whether or not China will weaponize its holding and engage in serious dumping of US Treasuries.

According to Bank of Singapore’s chief economist Mansoor Mohi-uddin, Beijing could force Washington to deal by selling down its US Treasury holdings, adding that «America’s extreme tariffs on China may not last throughout 2025». Other moves by China to try to obtain a favorable outcome include the curbing of rare earth exports, toughening regulations for US firms in the mainland and weakening of the Chinese yuan.

In contrast, J. Safra Sarasin believes such dumping is «unlikely». Mali Chivakul, the bank’s emerging markets economist, highlighted that while China has stopped accumulating more US Treasures, local state banks have continued to build up other US dollar papers and mass dumping would incur a major loss «hurting not only itself, but also other countries around the world».

Mar-a-Lago Accord

Elsewhere, there is a belief that President Donald Trump’s isolationist policies could trigger capital outflows through the sale of assets like equities and Treasuries, and help rebalance the trade deficit by significantly weakening the US dollar. This is sometimes referred to as the «Mar-a-Lago accord» which is based on a paper published by Stephen Miran, chair of the US Council of Economic Advisers. However, some private banks are not so convinced that this will play out.

According to Lombard Odier in a note by investment strategists Michael Strobaek and Dr. Nannette Hechler-Fayd’herbe, the bank believes the Mar-a-Lago plan is now irrelevant after the latest tariffs designed to correct trade imbalances and also due to the risk to inflation and US Treasuries from a devaluation of the greenback.

A separate note by Pictet authored by economists Frederik Ducrozet and Xiao Cui added that «the incentives in the accord are not strong enough to get the trading partners on board to cooperate, and the tools are poorly designed, potentially harming the dollar’s reserve currency status». Issues include a proposal to charge a user fee on Treasury repayments, risk to Fed independence and the difficulty of gaining cooperation from trading partners, particularly China.