Obituary: Swiss Banker and Eurobond Market Pioneer Robert Genillard

A Swiss banker who helped pioneer the Eurobond market and a legendary figure at Credit Suisse First Boston died, finews.ch has learned. A look back at one of the towering figures of European finance.

Robert L. Genillard (pictured left) who was born in 1929 in Switzerland and spent his youth in Lausanne, but wasted little time organizing passage to the U.S., where he initially worked in a beverage bottling plant while attending night school.

Robert L. Genillard (pictured left) who was born in 1929 in Switzerland and spent his youth in Lausanne, but wasted little time organizing passage to the U.S., where he initially worked in a beverage bottling plant while attending night school.

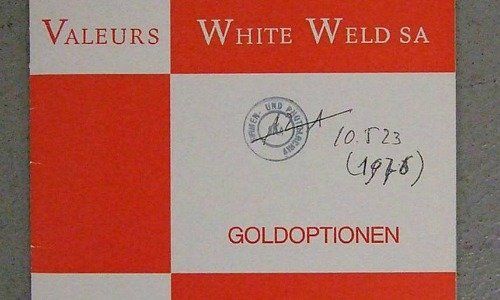

His big break came in 1954 when he was hired by White, Weld & Co., then a leading Wall Street brokerage house, a firm which he remained tied to for several decades. He made partner in four years and by the early 1960s, relocated back to Europe as the firm’s chairman and chief executive.

«Bob» Genillard correctly predicted that the Eurobond market would become the dominant force in debt-trading, easily outpacing any national capital markets which existed at the time. His vision remains true today, with an expansionary European Central Bank policy to stimulate the wider economy fuelling the trillion-euro market in London.

Warburg Connection

One of Genillard’s compatriots in the Eurobond market was Siegmund Warburg, the founder of venerable British merchant bank S.G. Warburg.

Warburg turned to Genillard to distribute the first Eurobonds, a $15 million issue for Italy’s Autostrada. The beginnings of what was to become a trillion-euro market was buoyed by a U.S. government policy forcing major companies to borrow abroad to fund their overseas operations.

Rudloff, Gruebel

Genillard worked alongside other renowned Eurobond market figures such as Michael von Clemm, Stanislav Yassukovich, John Stancliffe, and Sir John Craven at White Weld, hiring Hans-Joerg Rudloff, a Swiss banker who later became known as the «King of the Eurobond market» from Kidder Peabody.

Also in the mix: a young Oswald Gruebel, a young bond trader who was hired by Genillard in 1970 and went later on to run Credit Suisse – and UBS.

«Hot Money» in Eurobonds

Eurobonds were issued in bearer form, masking the buyers’ true identity, which led to «hot» money gushing into the market. Of the men involved in the Eurobond market’s beginnings, Genillard is the one who can be singled out as a genuine empire-builder.

White Weld was eventually merged into Credit Suisse First Boston (CSFB) , and its private banking operations laid the foundation in 1975 for private bank Clariden, which was later merged into the Swiss bank as well.

Spotting the Bugs

In the 1980s, Genillard went on to become CEO of Thyssen Bornemisza and later served on corporate board including Novartis and American Express.

He is survived by his wife of 60 years and five children. According to his daughter, Ariane Genillard-Cowley, he remained fascinated by emerging developments until the very end: the day before his death, he updated his iPhone’s software, delighting in spotting the bugs in it.