Liew Nam Soon and Evan K. Wiradharma from EY Financial Services talk about digitalization, robotics and the Indonesia financial services landscape.

Liew Nam Soon is EY ASEAN Financial Services Managing Partner and Evan K. Wiradharma is EY Financial Services Advisory Leader, Indonesia.

In the discussion you had with Financial Institutions (FIs), what are the key differences you have observed in the Indonesia financial services landscape as compared to the other ASEAN markets?

Evan (pictured left): Given Indonesia’s demographic, culture and values, there are a number of opportunities, from underserved to high net worth; from growing middle class to traditional or niche market, and with varying degrees on financial and digital versatility.

Evan (pictured left): Given Indonesia’s demographic, culture and values, there are a number of opportunities, from underserved to high net worth; from growing middle class to traditional or niche market, and with varying degrees on financial and digital versatility.

It’s an archipelago with a pyramid of 250 million people, 330 million mobile subscription, and where east to west takes more than six hours of flight time.

Nam Soon (pictured left): The ASEAN market as a whole is quite diverse, with each market having its own unique characteristic, culture and values. What this means for a lot of the global and foreign banks trying to get a foothold into ASEAN is the need to provide a differentiated service offering that’s tailored to the market they are entering.

Nam Soon (pictured left): The ASEAN market as a whole is quite diverse, with each market having its own unique characteristic, culture and values. What this means for a lot of the global and foreign banks trying to get a foothold into ASEAN is the need to provide a differentiated service offering that’s tailored to the market they are entering.

Indonesia is no different in that sense, whereby Evan has pointed out the two ends of the spectrum – the ultra-high net worth and digitally savvy to the currently still underserved population that’s open to alternative banking channels. This is actually observed in most of the emerging markets within ASEAN, including Vietnam, Philippines and Thailand.

The key difference would be the perception and attitude of the people towards financial services and the providers, which is influenced by the culture and values they hold, which would differ across markets.

How much progress has been made in respect of digital transformation in this market?

Evan: There has been significant investment and progression in general on digital transformation from process digitalization, digital business incubation and digital products & services offering.

There are strong propositions from the financial services industry such as banks and insurance companies, as well as other industries integrating with ecommerce, transportation, telecommunications, social media and etc.

«Indonesia consumers are becoming more receptive towards alternative brands»

Nam Soon: In our global banking outlook study this year, the top three priorities for banks are to optimize the customer channels (digitalization and self-serve), reduce cost through greater strategic efficiency and leverage new technologies like robotics for efficiency.

Within this study, majority of the respondents in Indonesia confirmed the same set of priorities in the next 12 to 36 months.

Our own observations and dealings with clients in this market indicates that there is still much to be done to prepare the FIs for digitalization. The FIs here are still having to deal with paper-based, analogue data, which is something that must be addressed in moving towards a digital platform.

Our global consumer banking survey 2016/2017 also shows that Indonesia consumers are becoming more receptive towards alternative (and likely digital) brands that offer a frictionless experience, especially around online and mobile banking.

Thus, there is definitely a push for transformation, driven both by the potential of selling new products and services to existing customers and selling to new, previously untapped customer segments like the underserved or unbanked population.

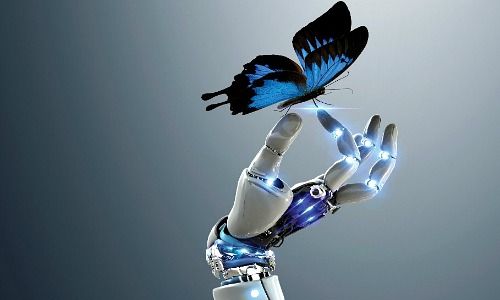

The discussion mentioned that FIs there are exploring the usage of robotics. Based on your experience, which areas can robotics have the greatest impact in the FI’s front and back office functions?

Nam Soon: From our work with clients currently, many are looking at robotics process automation (RPA) in their front and back office functions as a way to improve operational efficiency.

Robotics is making headway in risk and compliance areas like know your client (KYC) and anti-money laundering (AML) prevention processes.

«Robotics can come in the form of automated advice or digital advice»

In addition, time and costs spent on onshore or offshore services involving manual data entry, fact-checking and status monitoring can be channeled to more strategic roles requiring human intervention. This includes planning, defining frameworks, governance, evaluation, implementation, training and operational management of the robotics process and robots.

Robotics can come in the form of automated advice or digital advice. Digital advisors can be defined as a digital platform that provides automated, algorithm and data-driven financial advice with minimal human intervention.

«The local banking giants are continuing to innovate and collaborate with fintech companies»

For banks, this can actually help them deliver better and more accurate advice through data-driven insights. Automation also helps to reduce paperwork, which many relationship managers have to deal with currently. This frees up their time to be more focused on delivering strategic advice and focus on customer engagement.

The report also mentions that fintech collaboration is key. What are some examples of promising fintech innovations in Indonesia?

Evan: There is strong growth by transactions in ecommerce such as by Tokopedia, Bukalapak, and Lazada. Yet there are also still opportunities for regional players to expand into Indonesia, such as JD.com and Shopee.

On demand transport service providers such as Go-Jek and Grab are also offering services that extends beyond just providing transport. They are now going into groceries, courier and food delivery services with integrated electronic payment.

Meanwhile, the local banking giants are continuing to innovate and collaborate with fintech companies delivering mobile banking, e-money, and shared payment infrastructure to drive greater financial inclusion.