SME Financing: When Micro Becomes Too Small

Microfinance has become a firmly established practice in emerging countries. But if companies develop, it often becomes difficult for them to find the follow-up financing.

By Katharina Sommerrock, Philanthropy Advisor at LGT

Microfinance has become a firmly established practice for microenterprises in developing and emerging countries. But if one-woman/man companies develop into small and medium-sized enterprise (SMEs), it often becomes difficult for them to find the appropriate follow-up financing. This fact provides opportunities for investors who are looking to achieve financial and social returns.

Since its emergence in the early 2000s, microfinance has laid the foundations for the success of many microenterprises in developing and emerging countries. These successful microenterprises have the potential to grow into small or medium-sized enterprises (SMEs) and in doing so, can continuously offer employment and income opportunities to an increasing number of people.

SMEs as Economic Drivers

The rapidly growing populations in some developing and emerging countries are often underemployed or in a situation of precarious employment. The income poverty that goes hand-in-hand with this can be a breeding ground for violence, conflict and migratory pressure.

High-growth SMEs are an important factor in these countries when it comes to increasing employment levels, formalizing existing employment relationships, improving working conditions and reaching many of the UN’s sustainable development goals.

Too Big for Microfinance

However, for their positive impact to take effect and in order to grow further, SMEs in developing and emerging countries rely on access to suitable financing possibilities. But in these regions in particular, financial markets often still suffer from structural weaknesses: most microfinance institutions (MFIs) still focus on very small companies and commercial banks have only a limited interest in lending to young and smaller SMEs. Having outgrown microfinance as a result of their success, SMEs are therefore confronted with a funding gap.

(Harvard Center for International Development, Entrepreneurial Finance Lab)

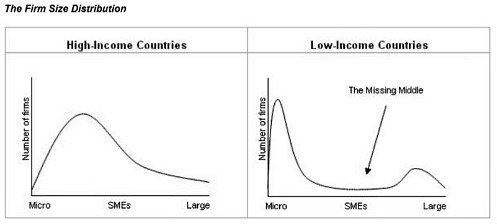

The insufficient access to loans and advice significantly limits their growth potential, resulting in the «Missing middle» phenomenon that can be observed in low-income countries. These economies are largely composed of microenterprises and only a few large-scale enterprises, while in high-income countries, the SME sector that lies in between is significantly more substantial and accounts for the bulk of economic strength.

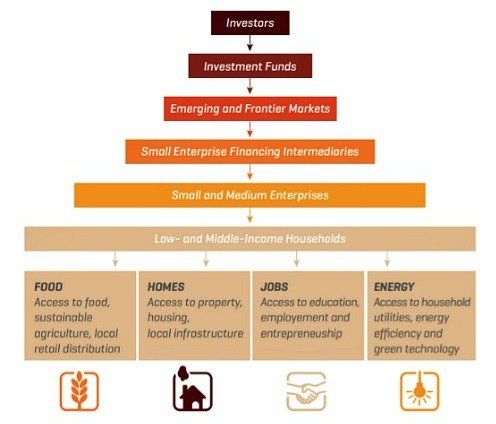

The Small Enterprise Impact Investing Value Chain

(Symbiotics (2013): Small Enterprise Impact Investing)

The good news is that more and more MFIs and a number of commercial banks have recognized this gap and are helping their clients to grow from microenterprises to SMEs by providing appropriate financing services. These enterprises use such services to further develop their business models and broaden their client base. At present, neither the market potential nor the capital required for reaching it is even close to being exhausted – the SME Finance Forum estimates that 200 million SMEs globally are in need of growth capital.

For investors who are interested not only in financial, but also social returns, this provides attractive alternative investment opportunities with a performance that is only marginally correlated to that of the global financial markets. Specialized providers such as Symbiotics, and banks such as LGT, are therefore increasingly giving their clients access to this type of offering and in doing so, are making it possible for their clients to contribute to the achievement of the UN’s development goals.