Profits Rise but Assets Drop at J. Safra Sarasin

The private bank controlled by Brazil's Safra family, Bank J. Safra Sarasin, improved its profitability last year. However assets under management declined.

Bank J. Safra Sarasin increased profit by 12 percent to 230.5 million Swiss francs last year, the firm said in a statement. The bank allocated the net profit for 2015 to retained earnings, boosting shareholders' equity to 4.1 billion compared with 3.8 billion at the end of 2014.

The Tier 1 ratio set by the Bank for International Settlements (BIS) was 27 percent, up from 25 percent a year earlier, easily in excess of regulatory requirements.

New Money From Asia

«Our financial strength has stood us in good stead over many generations and also enables the group to be a pro-active consolidator in the private banking market,» said Jacob J. Safra, vice chairman of the group, in the statement.

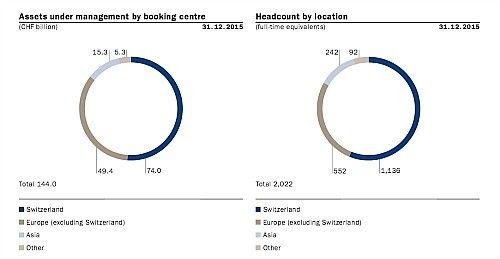

Assets under management declined to 144 billion francs from 146 billion at the end of 2014. Reasons for the decline were the currency effects following the lifting of the peg to the euro in January 2015 and lower valuations due to market conditions. New money mainly in Asia and the Middle East didn't entirely make up for the negative effects. The assets of Bank Leumi Luxembourg ($1.25 billion), acquired in November 2015, haven't been included in the full-year figures.

Lower Cost-Income Ratio

Currently in Asia J. Safra Sarasin has a headcount of over 240 people and assets under management booked in the region in excess of CHF15 million.

The cost-income ratio of 59.2 percent, is one of the best among private banks, the Basel-based institution said in the statement.