Don't Be a Lemming

With or against the current – fund managers are required to think about this question each day of their working life. Courage pays off, but you need to be patient.

Why do the lemmings jump off the cliff collectively? There are three known reasons for this:

1. All lemmings had the same belief.

2. All lemmings thought to be well-informed.

3. All lemmings wanted to stay with the herd.

Dot-Com Bubble

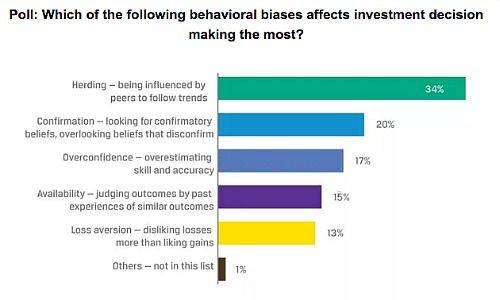

The lemming-effect is a well-known phenomenon and applies to investments as much as to other walks of life. The effect is making asset managers commit common mistakes, the CFA Institute of chartered financial analysts reported recently (see illustration).

The development and bursting of the dot-com-bubble is one of the most famous examples of herd-like behavior on the stock exchange. With dramatic consequences for individual investors.

Courage and Knowledge

Investors who buy when all the others sell will do better over time. To swim against the current takes a lot of courage and investment expertise. And not all investors have that. The reason: to go with the current for them is the safest way of keeping their job. That is certainly true of those with a lack of proper qualifications – and the institute claims there are quite a few of those.

Those going against the current however are individuals who don't attach themselves to a specific index, who stick to a strategy with a vision and thus stand out from the mass. But these anti-lemmings often need months or years to receive their rewards – and thus need patience and coolness.