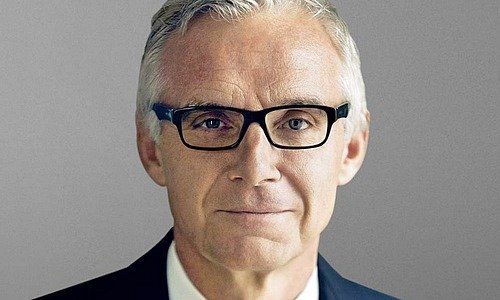

Urs Rohner: «Come On You Guys!»

In an article for a German newspaper, Urs Rohner writes about the bank client of the future. A good description perhaps of what the chairman of Credit Suisse is really all about.

Bill Gates' dictum lingers, in particular in the minds of the bankers: the founder of Microsoft once said that banking was here to stay, unlike the banks themselves.

A true warning sign if there ever was one now that we face the digital revolution, Urs Rohner, the chairman of Credit Suisse (CS) believes. Services have already been shifted to companies from the outside and giants such as Facebook and Amazon were ready to pounce, according to a commentary Rohner penned for Germany's «Handelsblatt».

But to throw up one's hands in despair is not the answer Rohner is looking for.

Courageous Embrace

Rather, and very much in tune with the best of consultancy-speak, Rohner recommends «positively accepting» the challenge and to «courageously embrace innovation». Our industry has to go and have a look-around at other industries and to think first about the customer. The relationship with clients had to be reevaluated from scratch, the CS chairman concludes.

Sounds good, but isn't entirely obvious.

The Empowered Customer

Rohner's bank today is focused more on wealth management and the private client since adjusting strategy in October of last year. He now says that an entirely new type of client is about to develop, an «empowered customer», a mature person who knows his strong position (evidently to the contrary of customers earlier).

The new client wants a range of things, is demanding, price sensitive and has no understanding for banks' effort to standardize. Still, banks will have to provide tailor-made and nevertheless standardized products, a sophisticated level of individualization in a standardized fashion – the true challenge for banking, Rohner writes.

Well, it isn't that clear.

Consumption Equality

The hardest nut to crack will be the so-called «consumption equality». Luxury products such as private bankings will develop into goods for the mass markets, Rohner says.

«To offer a broad customer base previously exclusive products will provide new options despite the pressure on margins,» he says.

Exclusive products for the mass market – a contradiction that Swiss private banking is currently struggling with. The recipe for the future as described by the CS chairman can be understood as a sign of helplessness of an industry challenged by the questions described.

Fill Gaps with Optimism

But Rohner is eager to fill the gaps with optimism, saying the industry need not to despair in spite of the trends and facts. He believes that banks do have a future as long as they are the best and most complete partner for the customers.

Unfettered optimism in the eye of the unknown – the recipe of the CS's highest strategist?

Perhaps. After the heavy turbulence, which wiped 40 percent off the value of the bank this year and a string of calls for his resignation, Rohner recently said he aimed to stay on as chairman beyond 2018.