Play UBS' Trump-Era «End Game»

Have you ever wanted to be dictator of your own nation? Now you can, thanks to UBS, which has created an online game for users to create – and potentially destroy – their own national economies. finews.com gave it a try.

You've just been appointed leader of a major country, with monetary, fiscal, and foreign policy control. How far would you go to juice your own economy, UBS' investment chief Mark Haefele asks in a new, ominously titled «end game» built with more than a veiled reference to President-elect Donald Trump.

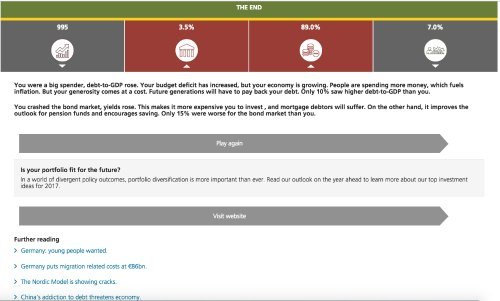

Users make choices for their country, like spend money or pursue populism, print or spend money, maintain stimulus, raise interest rates, or tax and spend. Meanwhile, a tracker reflects how well the choices reflect in stock market performance and bond yields as well as debt-to-GDP ratios and unemployment.

finews.com's first attempt saw mixed results: copious spending juiced growth. People spent more, which fueled inflation. The government's generosity came at a cost: debt surged, leading the bond market to crash. Yields rose, meaning it became more expensive to invest and mortgage holders suffered.

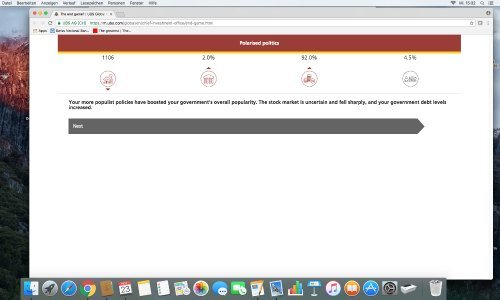

finews.com tried again, trying to guess at what Trump's decisions might be based on his campaign comments on immigration, monetary policy and trade.

Maintaining monetary stimulus, coupled with populist rhetoric, was taken well by the stock market, but gradually discontent grew among voters over a widening wealth gap. In response, finews.com doubled down on its populist views which bolstered the government's popularity, but the stock market teetered with uncertainty and government debt rose.

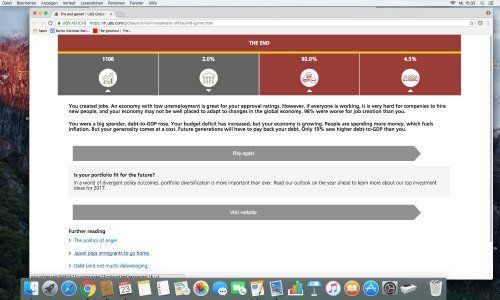

With immigration restrictions in place following the rhetoric, the working population began dwindling. And the first signs of crisis emerged: growth slowed and debt rose.

finews.com chose to print money to pay down debt budgetary spending to kickstart growth, which worked: GDP rose, borrowing costs fell, and the government reduced debt to the private sector. Big government spending fueled growth and with it popularity ratings. The only bittersweet note: future generations are saddled with a huge budget deficit.

Trump officials are scrambling to put together an economic team, after J.P. Morgan head Jamie Dimon reportedly turned down the Treasury Secretary position in the new administration. If Trump is unable to enlist any of his friends on Wall Street as economic advisors, perhaps a spin around the UBS «end game» can provide some ideas?