This Is What Your Client Wants

Private banking in Asia, once hailed as the promised land, is today as tough a business as any. Tight margins, aggressive competitors and a failure to understand the needs of their customers is making life hard for bankers.

Among wealthy Asians about one in three is unhappy about the performance of their bank of choice, according to a survey by EY consultants. The share of unhappy customers in Asia is comparatively high – in the U.S. for instance the same figure is 20 percent.

The unhappiness seems to stem from the delta between the banks' approach to customer care and expectations of the rich themselves, according to «The Experience Factor», the EY study.

Discrepancy Between Needs and Services

A majority of 57 percent of financial-services companies for instance believes that the relationship manager remains the most important channel of communication to the client. But only 32 percent of customers actually share that view – all others, which is two out of three, prefer digital channels.

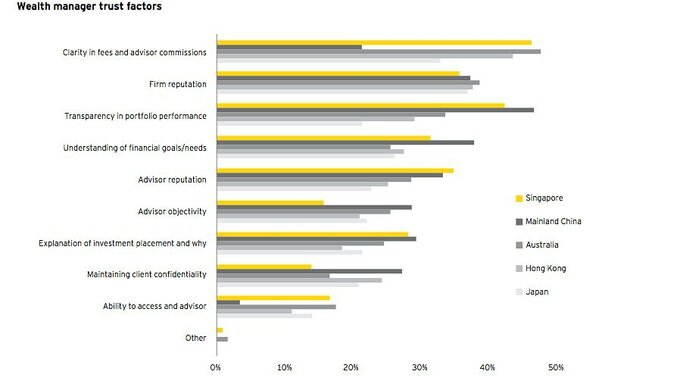

So which are the main factors influencing the choice of bank in Asia?

1. Transparency About Fees and Commissions

Banks need to be transparent about how they price their services. Customers in Asia tend to have accounts at more than one bank and thus are used to making comparisons.

2. Reputation Matters

Asian clients chose their bank according to the reputation of the institution. A traditional family-owned bank such as Lombard Odier or a princely connection as with Liechtenstein's LGT can be of importance.

3. Transparency of Performance Reporting

Private-banking clients in Asia typically are entrepreneurs, people who know their numbers. This type of client wants to know exactly how his investments are performing. The bank has to provide a modern and transparent accounting system and relationship managers need to be able to explain those numbers in detail.

4. Understanding the Needs

The financial needs and goals of clients change over the lifecycle of a relationship. At one point, an entrepreneur needs a credit, at another he may want to withdraw from his business and take out capital. And at a one point there comes the time when the entrepreneur passes on his business to somebody, perhaps his children, perhaps to a buyer. A relationship manager needs to remain flexible and show the required level of empathy for his client.

5. The Reputation of the Adviser

The relationship manager evidently has to have impeccable manners and a clean reputation. The Asian customer tends to put more emphasis on such aspects than on the level of competence of their bank managers, which may come as a surprise to European banks.

6. Objectivity

The private banker is employed by the bank and has to generate revenue. But he or she has to be careful not to view customers as a cow to be milked. Asian customers know very well when a discussion with the relationship manager turns into a badly disguised sales pitch. It pays to be objective and modest.

7. Investment Expertise

A relationship manager needs to be able to explain what he does with the assets of his client. This is part and parcel of modern-day private banking.

8. Client Confidentiality

In our times of ever increasing transparency, customers want to safeguard their assets. Building trust with customers who seek protection must be the highest priority for banks.

An Overview of the Important Aspects in Private Banking