Banking Industry: Fines and No End

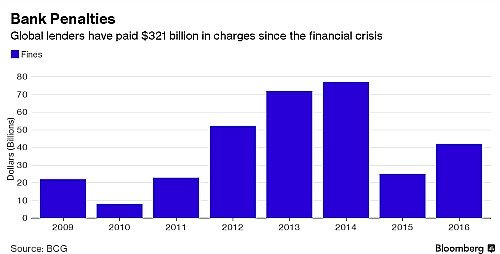

The total of the fines that banks have been forced to pay since the beginning of the financial crisis is a figure with nine zeros. And there’s little hope that we have seen the end.

$321,000,000,000: That’s how much banks globally have had to pay in fines over the course of ten years for regulatory infringements such as money laundering, market manipulation or terrorist financing, «Bloomberg» reported, citing a study by the Boston Consulting Group (BCG).

The tally is set to rise in coming years as European and Asian regulators are stepping up their fight against financial wrongdoing. So far, the majority of fines were the result of investigations by U.S. authorities.

Major Increase in 2016

The banking industry in 2016 was forced to pay $42 billion to make amends for violating a wide range of regulations, an increase of 68 percent from a year earlier (see table).

Credit Suisse: Fines Hurt

Credit Suisse (CS), Switzerland’s second-largest bank, is a good example for how the fines affect the industry. The bank last year agreed to pay $5.3 billion to settle a dispute over mortgages in the U.S. and therefore was forced to report a loss for the full year. UBS in coming months may be asked to pay up for the same reason and separately is facing a tax dispute in neighboring France.

Fines will remain a reality for the banking industry as regulations have become much tighter and because of private claims, the consultants said. The companies simply have to learn how to best deal with the expense incurred through the investigations.

Profitable Asian Banking Industry

BCG says that banks so far have had limited success in doing so. Based on the so-called economic profit of the banks in the six years through 2015, they are 9 billion euros in the red, the consultants said.

The European industry has fared particularly badly, posting a collective economic loss in every year since 2009. U.S. competitors managed a profit in the past three years, while Asian banks remained profitable throughout.