Credit Suisse Tax Probe Hits U.K.

Credit Suisse's problems with a five-nation tax investigation just got worse: after four arrests in Holland last week, British authorities are ramping up the pressure on alleged tax cheats in the U.K.

Swiss bank Credit Suisse continues to be mystified by a Dutch-led probe into alleged tax cheating in Europe and Australia. The bank was blindsided by raids in Holland and France last week as well as a visit to its London office. Dutch authorities tweeted their spoils from raids in private homes in four cities (see below).

At the time, authorities said more was to come, and they were right: on Wednesday, a 46-year-old British woman was arrested at her home following a joint investigation of Dutch and U.K. authorities, newswire «Agence France Presse» reported. More than 6 million euros in assets connected to the woman were seized.

Laundering, Tax-Cheating

If Credit Suisse, which has until emphasized that the probe focuses on clients and not the bank itself, had hoped the matter could be contained in Holland, the U.K. arrest will dash those hopes. The arrival of the probe in the U.K., a showcase market for Credit Suisse, where it caters to clients with more than £2 million in investable assets, is bad news.

Dutch and British authorities didn't name the bank, and didn't link last week's arrests to the most recent one.

The woman had been investigated along with her 51-year-old Dutch husband into suspicions the couple used a Manchester-based business to launder money and cheat on their taxes by using accounts in the Netherlands, Germany and Austria.

Two villas in the Netherlands, luxury cars and a speedboat were among the assets seized from the couple in raids on them in Britain and the Netherlands but also in Austria – meaning the probe has spread to yet another European country.

Big Cash Withdrawals

The couple raised suspicions by withdrawing more than 300,000 euros in cash from Dutch banks using credit cards linked to foreign bank accounts, the Dutch investigator said.

«The woman allegedly laundered the money from criminal proceeds in the Netherlands, where the two suspects own two homes and where they regularly stay,» Holland's investigator said.

Just how deeply entrenched Credit Suisse's private bank is in the probe is unclear.

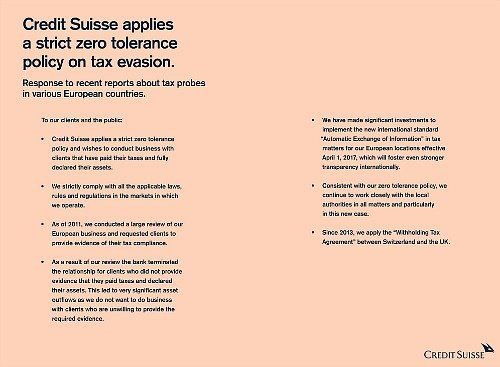

The bank, which is grappling with how best to replenish its depleted capital, took out full-page ads in British newspapers underlining its «zero tolerance» stance on tax evasion (see above).

Credit Suisse is the only bank to emerge in the initial days of the six-country probe. Whether this is because Credit Suisse acted, against its assurances, particularly egregiously, or whether investigators are focusing on individuals as opposed to institutions in their probe is unclear.