DBS CEO: «Headwinds Remain»

Singapore's largest bank DBS Group announced net profit for first-quarter 2017 was up 1 per cent from a year ago as fee income climbed to a record. The CEO however warned that headwinds remain in the oil and gas support services sector.

Including one-time items, net profit for DBS over the first quarter of 2017 was $1.25 billion Singapore dollars.

As finews.asia reported, there was a gain of $350 million Singapore dollars from the disposal of PWC Building in Singapore. DBS sold the Cross Street building to a unit of Manulife Financial Group.

The amount raised was set aside as general allowances, raising general allowance reserves to $3.49 billion Singapore dollars.

Wealth Management

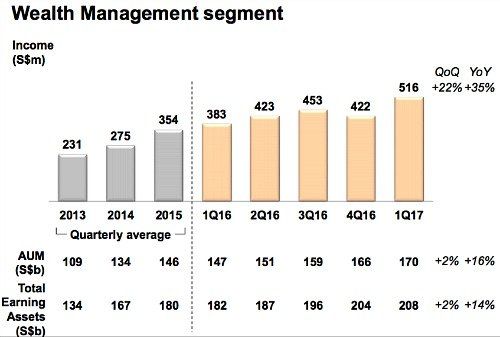

The wealth management unit which sits under the umbrella of «Consumer Banking and Wealth Management» was robust with income rising 13 percent to S$1.16 billion. The increase was across all product segments and led by double-digit percentage growth in investment products.

The assets under management (AUM) are now $170 billion Singapore dollars. This figure includes the mass affluent offerings as well as the private bank AUM. Fee income for this segment also rose to $222 million Singapore dollars.

In acquiring the retail and wealth management business from ANZ $10 million Singapore dollars of integration costs was accrued.

«We have had a good start to the year. Earnings were maintained at the quarterly high achieved a year ago as business momentum and productivity gains were sustained, while asset quality pressures appear to be moderating, we remain vigilant to continued headwinds in the oil and gas sector,» said Piyush Gupta DBS CEO.