Switzerland remains the largest wealth hub in the world, but its private banks are giving short shrift to the very segment they supposedly dominate. Who is winning big as a result?

At first blush, the private banking industry in Switzerland looks in fine fettle: managed assets hit $2.2 trillion last year, according to the an annual wealth report compiled by Boston Consulting Group (BCG).

The alpine nation still dominates wealth league tables, outstripping rivals like Singapore, Hong Kong, the U.K. and Dubai in assets. But the end of banking secrecy has taken a toll – and left Swiss private banks scrambling to reinvent themselves without what was often their primary advantage.

A rise of 7 percent (in local currencies) and 12 percent in U.S. dollar terms last year is largely down to a favorable market tide which has hoisted all boats, and not private banks winning huge new assets, as a study by Scorpio Partnership noted last week.

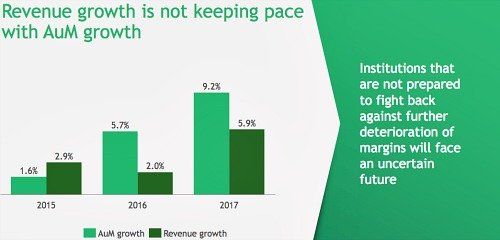

This is illustrated in the spread between net new money growth and revenue off the assets, BCG partner Anna Zakrzewski said at a media event in Zurich. While the average assets rose 9.2 percent in the last two years, revenue only climbed 5.9 percent (see graphic below).

In other words: Swiss private banks aren't translating their new assets into commensurate revenue. Why? Pricing pressure is one reason: tougher competition and the effect of digitization are forcing wealth managers into a corner. Costs including for regulation are rising at the same time, leading to a painful double whammy.

Switzerland has been especially hit by this dual effect: the country's private banking assets stand at $3.8 trillion, which translates to a 3.5 percent rise from 2012. But the return on assets under management – or revenue against client funds – worsened a full 15 percent within the same five years (see graphic below).

What led to the profit drop? Mainly traditional offshore business, particularly that with European clients. The end of secrecy and the subsequent rollout of data-swapping with Europe and others have led to a drain of funds from Switzerland. Switzerland's finance industry has yet to prove that it can offset the siphon with other, equally lucrative revenue elsewhere.

Badly-Served Clients

- Page 1 of 2

- Next >>