UBS Extends Lead as Asia Rises

Swiss bank UBS extended its lead over rivals as the world's largest wealth manager in a widely-watched annual ranking. Asian private banks made the steepest gains.

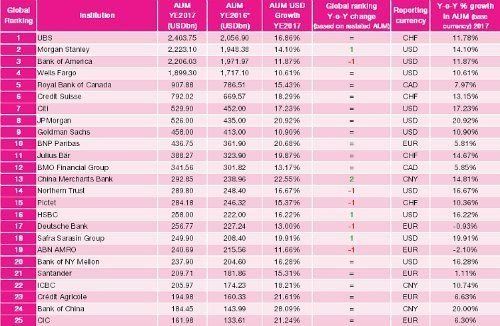

With $2.403 trillion in client assets, UBS defended its lead over North American and European rivals as the world's largest private bank, according to a league table compiled by London-based wealth management consultancy Scorpio Partnership.

The Swiss bank muscled out U.S. broker rivals Morgan Stanley, Bank of America, and Wells Fargo as well as the Royal Bank of Canada, which rounded out the top-five. The rising tide of financial markets and a wider economic pickup fueled the industry, but banks are also getting savvier about winning a bigger so-called share of wallet.

To wit: in the last study, the share of net new money within overall assets was flat. In 2017, the contribution rose to 4.3 percent among firms which report the data (not all of them do), Scorpio noted.

Chinese Advance

Chinese banks which cracked the top-25 for the first time last year – China Merchants Bank, ICBC, and Bank of China – continued their advance into wealth management. CMB climbed two spots to 13th, with $292.9 billion in assets, now within striking distance of the top-ten, while the other two defended their spots.

The Asian wealth managers posted an average of 15.2 percent growth in assets last year, more than double that of Europe (7.5 percent), and somewhat faster than their North American rivals, which racked up 13.8 percent growth.

Most notably, Bank of China posted double-digit asset growth for the second year in a row, helped by marketing, profiling clients, and improvements to its offering.

Pictet, Deutsche Bank Slip

Strategic dealmaking in several emerging markets by Asian banks also bolstered assets, the study's authors said. «Many wealth managers present in Asia continued to increase their focus in this region in 2017.»

Asia generally represents the world's fastest-growing wealth market, but the U.S. continues to be the largest. Banks need a foothold in both markets, like the big American brokerages and UBS, to figure in the global league tables.

As much as UBS has dominated the ranking in recent years, Credit Suisse, American banks Citi, J.P. Morgan, and Goldman Sachs as well as France's BNP Paribas held steady to round out the top-ten this year. By contrast, U.S.-based Northern Trust edged one perch lower to 14th, Swiss bank Pictet slipped by one spot to 15th, and Germany's Deutsche Bank fell to 17th.