UBS Shares: Ready for Takeoff?

It is one of the many ironies of history that UBS stock should surge right at the moment when veteran CEO Sergio Ermotti is stepping down. Has the departing banker been successful in planting the seeds for a return of fortune?

The share price was the Achilles' heel of Sergio Ermotti throughout his last years at the helm of Switzerland's largest bank. Despite his best efforts the shares barely budged. In all, the stock rose a paltry 2 percent over the long years of his tenure; currently, at a price-to-book ratio of 0.78 percent, the shares trade well below the intrinsic value of UBS.

Two years ago, Ermotti even ventured as far as investing a whole year's income in UBS shares. Even this personal and public investment didn't kickstart the shares.

Dig at U.S. Rivals

It must have struck the CEO as pretty ironic then that the UBS share for most of the day was the biggest riser on the benchmark SMI on Tuesday following the presentation of the third quarter. The shares surged precisely at the moment when Ermotti presented the last quarterly figures and new Dutch CEO Ralph Hamers is about to take over from the banker who originates in the Italian-speaking part of Switzerland. The basis for a sustained recovery looks to have been laid.

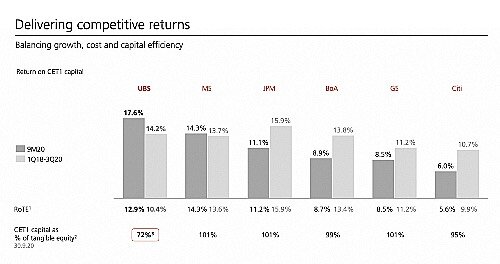

One indication – maybe it was intended as a dig – for such a development came in the presentation of the numbers yesterday. One of the tables the bank presented showed how UBS had outperformed a series of U.S. giants in the key figure of return on capital, a number that investors are observing closely. Evidently, the conclusion to be drawn was that a Swiss bank still was able to turn the table on what may observers had deemed to be dominant U.S. rivals.

The English-speaking media seized upon this table, with «Bloomberg» (behind paywall) commenting that UBS had overtaken Wall Street banks thanks to the trading boom that followed in the wake of the pandemic.

Boredom Finally Pays

The gap between the Swiss No. 1 and the U.S. banking guild has indeed narrowed during the months of the pandemic – even if the level playing field seems a long way off. The Swiss are having to deal with much fewer pandemic-induced write-downs than the U.S. firms because Ermotti forced the bank to shift its focus to global wealth management.

U.S. companies reckon they are facing a wave of write-downs in retail and corporate business totaling billions of dollars. UBS however expects that the value adjustments on credits in the fourth quarter will be significantly below those of the first half of the year.

«For Sergio Ermotti, UBS' Boredom Finally Pays,» finews.asia wrote in the summer. Autumn has brought confirmation for this.

A Low-Rate Environment for All

The playing field has become more level in terms of interest. U.S. banks today face a similarly persistent low-rate environment, a blow to the interest margin of any bank. UBS has had to contend with low rates ever since 2015 when the central bank introduced negative rates following a surge in the value of the franc. UBS was under pressure to adjust its business to the new circumstances. The U.S. banking industry is about to find out what that entails.

Apart from the pretty good performance during the pandemic, UBS has one more trump to play that traders will love: dividends. UBS promised to pay out the second half of the dividend promised for 2020, the half that the bank had deferred during the spring lockdown. It also signaled its intention to put $1.5 billion aside for eventual buybacks starting next year.

Such measures will give any stock price a boost and will likely have been the reason for the rise in the share price on Tuesday.

Legacies Remain

Investors will be well aware that the bank is not totally in the clear though. Some legacies remain and will weigh on the shoulders of Ermotti's successor. There are some legal risks, including the yet-to-be concluded tax dispute with France, where the bank is fending against a fine of a total of 4.5 billion euros. Another case is pending in the U.S., with toxic RMBS papers as well as further potential tax conflicts.

The stock – like most banking shares – is also trading at a discount due to the risk of disruption. Fintechs and neobanks seem to be taking some of the cake, the UBS retail banking figures for Switzerland suggest. Digitization has accelerated further as a consequence of the pandemic. UBS hasn't really increased the speed with which it is pursuing innovative ideas – apart from the digital platforms such as Key4.

More Digital and Agile

In that respect, it isn't Ermotti's legacy that may boost the shares but his departure: Hamers is known as a banker who demands and supports digital change. He is expected to make UBS not just more digital but more agile as well. Some sacred cows are waiting to be slaughtered.