Europe's Last Outcry Trading Floor to Close

The last European outcry floor is due to be closed this spring. The digitization of securities trading is likely to wipe away the last remnants of the old stock exchange trading in London this year.

The London Metal Exchange (LME) already had to suspend its activities last March when the first wave of the pandemic swept across the U.K. At the time, the exchange management promised that open trading would resume once the pandemic subsided. Meanwhile, the exchange has reconsidered and is mulling the closure of the open ring exchange after 144 years, according to Wednesday's edition of «The Times».

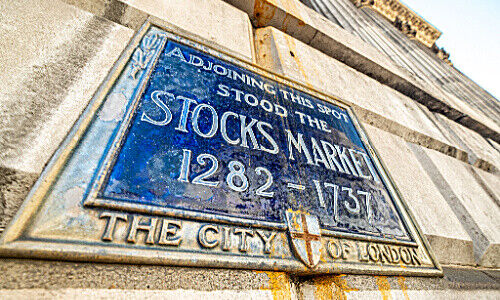

The closure of the last ring in Europe marks the end of an important chapter in the financial industry. However, the end of the open market was written on the wall, with first floors closing decades ago – in Zurich, for example, the ring was abandoned in favor of electronic trading a quarter of a century ago, in August 1996.

The Electronic System Convinces

The Corona crisis may not be the reason for the final closure of the open LME, but the triggering moment came with the crisis. Exchange participants shifted their trading activities last spring to a computerized system with electronic pricing and some telephone trades. And apparently, the new system won over LME management: «We have now got an awful lot of data which shows that electronic pricing has worked,» as Matt Chamberlain, the exchange's CEO, is quoted in the report.

The ring turns over $46 billion annually in trading metals such as aluminum, copper, lead, and tin. The floor, with red sofas arranged in a ring, was used by more than 150 traders each day and is the last witness to a centuries-old tradition in Europe.

In Chinese Hands Since 2012

Chamberlain's statement emphasized the difficulty of the decision given its long history. However, the LME expects to generate substantial added value with electronification. For example, the exchange's revenue has increased markedly since the switch in March 2020. In addition, the business should benefit from a broader participant base and improved pricing transparency.

The LME has been owned by Hong Kong Exchanges and Clearing since 2012, which at the time paid £1.4 billion for the company.