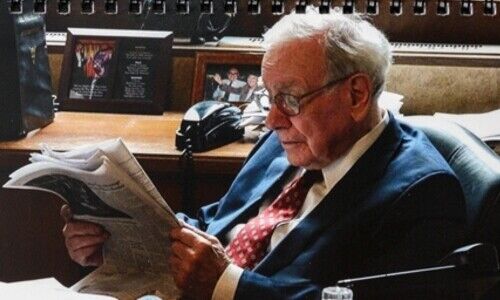

Why Warren Buffett Is Sitting on $321 Billion in Cash

Warren Buffett’s latest shareholder letter highlights Berkshire Hathaway’s record cash pile, a lack of compelling investment opportunities, and his signature blend of wisdom and wit. What can investors take away from the Oracle of Omaha’s newest insights?

Berkshire Hathaway, the trillion dollar investment company led by Warren Buffett since 1970, ended 2024 with an eye-watering $321.4 billion in cash and Treasury bills – a figure that is increasingly raising eyebrows among investors.

However, in his eagerly anticipated letter to shareholders, Buffett reassured them that the company’s strategy remains unchanged. «Despite what some commentators view as an extraordinary cash position at Berkshire, the great majority of your money remains in equities,» he wrote, while emphasizing that the firm will never prioritize cash-equivalent assets over strong businesses.

Success in Japan

The letter also reflected on Berkshire’s performance, with operating earnings reaching $47.4 billion in 2024, a significant increase from the previous year. Meanwhile, Buffett’s expansion into Japanese trading firms continues, with Berkshire’s holdings in these companies rising beyond previous limits.

Buffett’s letters are not just financial reports but a masterclass in investment philosophy. With his signature anecdotal style, he shared the story of Pete Liegl (1944-2024). As founder of Forest River, which was acquired by Berkshire Hathaway in 2005, he was an unsung hero in Berkshire’s portfolio, whose recreational vehicle business became a major success.

Buffett also acknowledged his own missteps, openly discussing past investment errors.

Waiting For Cheaper Valuations

At 94, Buffett remains as candid as ever, reminding shareholders that Greg Abel, chairman and CEO of Berkshire Hathaway Energy, will eventually take the helm at Berkshire. Still, his letter makes it clear: the Buffett way of business—patient, pragmatic, and deeply rooted in American capitalism—will remain intact.

While Buffett refrained from calling the market overheated, he noted that good opportunities are scarce. «Often, nothing looks compelling; very infrequently we find ourselves knee-deep in opportunities,» he observed. This suggests that Berkshire’s cash reserves may remain high until valuations become more attractive.

Investor-Philosopher from Omaha

For long-term investors, the letter reaffirms a core Buffett lesson: patience pays. As market conditions evolve, Berkshire’s fortress of cash is a sign not of hesitation, but of readiness for the right opportunity.

Buffett’s 2025 letter once again blends financial rigor with timeless wisdom. Investors looking for quick tips on stock picking may be disappointed, but those seeking lessons on resilience, discipline, and long-term wealth creation will find plenty to chew on.