UBS' Big Private Bank Winner

UBS' private banking mega-merger boosts the influence of one private banker enormously: Joe Stadler. The Swiss bank's head of ultra-wealthy clients fought long and hard for the promotion, finews.asia can reveal. A profile.

Joe Stadler isn't much-loved within UBS, but the new head of its global ultra-rich push is widely respected and admired. The 55-year-old veteran private banker's advance in a management shuffle sparked by UBS' mega-merger last week was long in coming.

When he joined UBS nearly nine years ago, UBS was still reeling from the financial crisis of 2008/09 and struggling to stanch a massive withdrawal of assets by its wealthy clients. The ultra-rich segment is the highest echelon in private banking, open only to clients and families with more than $50 million in bankable assets. It is also widely viewed as the most demanding – and lucrative, with clients paying extra for customized products they can't get elsewhere.

When Stadler joined UBS, the segment was discreetly called «key clients,» and was still being led by Juerg Zeltner, who had taken the helm of the overall private bank one year before.

Quick on the Draw

Since then, Stadler has built the super-rich segment into one of the private bank's most important – and a key focus of top management under CEO Sergio Ermotti. Stadler didn't adopt the delicate and discreet manner better known by private bankers such as Bernhard Hodler at Julius Baer.

As a former investment banker, he is accustomed to elbowing his way through turf wars, and he adopted pushier trading room methods during nine years as head of J.P. Morgan in Switzerland. Targeted, calculating, ambitious, and ruthless when necessary is how associates and colleagues describe Stadler. One likened him to Lucky Luke, a cartoon gunslinger popular in Europe known for «shooting faster than his shadow».

Prominent Victim

Paul Raphael is a prominent victim, as finews.asia has reported. Under Zeltner, the British-Lebanese banker was effectively UBS' second most powerful private banker, responsible for Europe and emerging markets. But Raphael doesn't have a seat on top management after the mega-merger in wealth management – he will be replaced by former HVB banker Christine Novakovic. While UBS has said it is looking for a new role for Raphael, he isn't expected to stay for long.

For her part, Novakovic will run a far smaller unit than Raphael's previous one. Why? Stadler had managed to draw UBS' ultra-high net worth clients from Asia, Switzerland, Europe, and emerging markets into one unit – that he is fully responsible for, operationally and financially.

Winning Turf

What sounds unremarkable is in fact significant: Stadler is no longer head of a specialist area, but has carved out a business area for himself, alongside for example Edmund Koh in Asia or Anton Simonet for Switzerland – as well as until recently, Raphael.

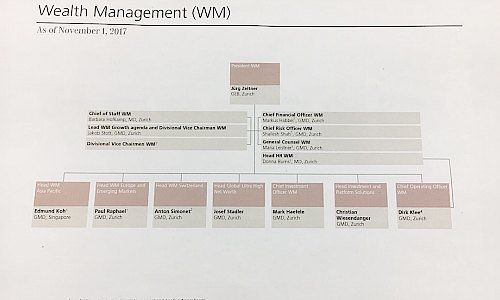

Org Chart, November 2017

- Page 1 of 2

- Next >>