BIS Chief Economist: «No Security With Cryptocurrencies»

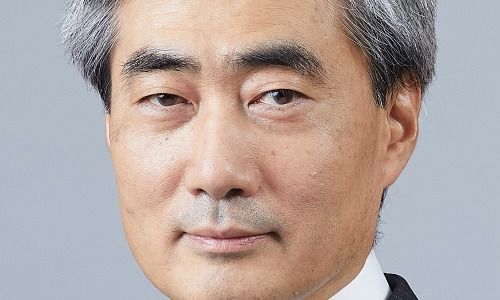

Cryptocurrencies are not – as is widely believed – a prerogative of the many, but in the hands of a very few people, Hyun Song Shin, chief economist at the Bank for International Settlements, tells finews.asia.

Hyun Song Shin, will cryptocurrencies such as bitcoin soon replace the franc and the dollar?

Certainly not. They lack all the attributes that distinguish traditional money and which makes it so popular.

Could you please elaborate?

The miners, the people who generate bitcoin with the help of a lot of computer capacity, don’t just produce cryptocurrencies, they also administer each unit.

The miners, just like accountants, have to keep an electronic protocol of each transaction in which cryptocurrencies have been used. This requires an effort and generates costs. Therefore, the use of cryptocurrencies involves paying a fee.

«Miners are doing good business»

If demand for cryptocurrencies is high and computer capacity low, the fees will be high. The miners are doing good business.

And users of cryptocurrencies inversely have to pay more. Why?

I will use an example to explain: in December, the fee for a payment was an average $57. If you were to pay a $2 coffee in bitcoin, you’d have to add $57 in fees.

«This problem doesn't exist with traditional currencies»

The miners therefore have an interest in keeping fees high, or put another way, create tailbacks. But this makes cryptocurrencies less attractive. Experts call this a lack of scalability. This problem doesn’t exist with traditional currencies. You don’t have to pay a fee for buying bread at the bakery with Swiss francs.

Are there any other factors that can be held against cryptocurrencies?

- Page 1 of 2

- Next >>