LinkedIn Deal Showcases Ex-CSFB Star Banker

Microsoft’s $26 billion deal to acquire professional network LinkedIn means a fee boom for investment banks. A prominent former CSFB banker is behind the megadeal.

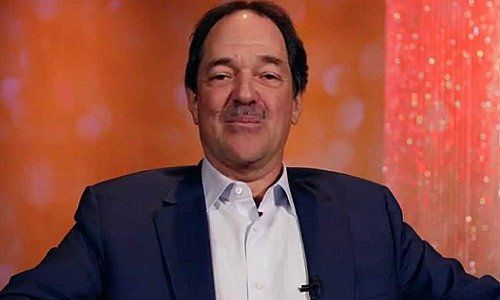

Frank Quattrone was CSFB’s star technology banker before he was accused of obstruction in a probe of whether the bank was allotting IPO shares to preferred clients for big commissions. He later reached a settlement with the government – admitting no wrong-doing – and set up his own boutique firm, Qatalyst, shortly after.

Quattrone vs Credit Suisse

Quattrone has made little secret of his feelings for Credit Suisse, even as he competes with his former employer for new deals. In April, after a «Wall Street Journal» story highlighting the investment bank’s disgruntlement with management, Quattrone tweeted his lack of surprise that the bank would «throw a top performer under the bus».

Hard to believe CS would throw top performer under the bus + blame him for problems others caused..oh, wait I forgot https://t.co/F92SJYGm8B

— Frank Quattrone (@FrankQuattrone) April 29, 2016

The comment, which referred to Gael de Boissard, who left Credit Suisse following a wide-ranging restructuring and management shake-up last October, made clear Quattrone felt he had also been treated unfairly by the bank.

Revenge of Sorts

Now, Quattrone is celebrating a revenge of sorts in that Qatalyst is the lead advisor of the Microsoft-LinkedIn deal, which he feted as the the largest Internet deal of all time. Allen & Co. and Morgan Stanley are also among the deal’s advisers, which neither of the Swiss banks were in on.

For Credit Suisse, the shut-out is less surprising: the troubled bank lost at least 8 bankers in San Francisco recently, as finews.ch reported.