After months of evaluation by the Swiss authorities, the China Construction Bank has received a banking license. The head of the Zurich branch of the Chinese banking giant has already been named, research by finews.ch showed.

A new heavyweight is set to open shop on Switzerland's financial market: The China Construction Bank has received a license to open a branch in Switzerland. The Swiss regulator Finma confirmed a report by finews.ch.

CCB applied for the license in March. The bank will have to undertake some preparatory work before being able to enter its brand in the commercial register of Switzerland and before it can start operating, a Finma spokesman told finews.ch. The regulator wasn't to be drawn on how long this might take.

Head of Branch to Be Presented Soon

The Chinese have however already decided who will head its Swiss business. CCB named David Gong general manager of the new branch in Zurich, people familiar with the opening of the branch told finews.ch.

The manager, hitherto unknown to the Swiss banking community, will be presented at the end of October. He will put in an appearance at the «Geneva Roundtable on Sino-Swiss Synergies in Trade Finance» on October 30, organized by the Graduate Institute Geneva and the Association of Foreign Banks in Switzerland. Gong is listed as head of the «Zurich preparatory team».

Years of Hard Work

The company has yet to answer the questions presented by finews.ch. KPMG Switzerland, which played a key role in preparing the opening of the Zurich branch of CCB, declined to comment.

«We're pleased about the award of a Swiss banking license to the China Construction Bank (CCB),» the economics department of the canton of Zurich said. The department worked for four years to lure the Chinese banking giant to Zurich. Delegations from Zurich repeatedly visited China under the leadership of then Finance Director Ernst Stocker.

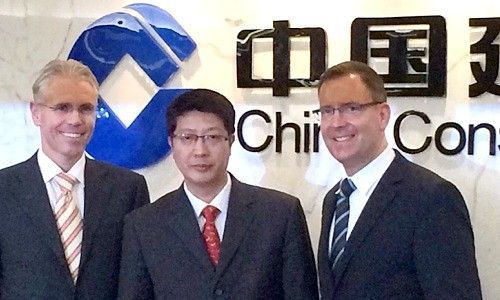

Bruno Sauter, head of the economics department at the canton of Zurich in spring 2015 travelled to the People's Republic, accompanied by Hans-Peter Portmann, a banker at LGT and member of the parliament in Bern. The delegation brought greetings from Federal Finance Minister Evelyne Widmer-Schlumpf.

(picture below, from left to right: Bruno Sauter, CCB-Manager Gong Weiyun, Hans-Peter Portmann)

Federal Delegation Visit

Last but not least, a delegation of the federal authorities and Swiss banking visited Beijing in August, meeting with a high-ranking group of bankers of the People's Republic.

The hard work of the Swiss seems to have paid off. Swiss banking achieved two mile stones with the award of the license to CCB. The opening of a branch by a Chinese bank is one of the conditions for a trading hub for the renminbi, the Chinese currency, which Switzerland has tried to land for years.

The representatives of Switzerland's financial market were eager to close a less successful chapter – the closure of the branch of Bank of China (Suisse) in Geneva. Opened with high expectations in 2008, business was far from brisk and the Chinese finally pulled the plug in July 2012, selling the rest of the business to Julius Bär.