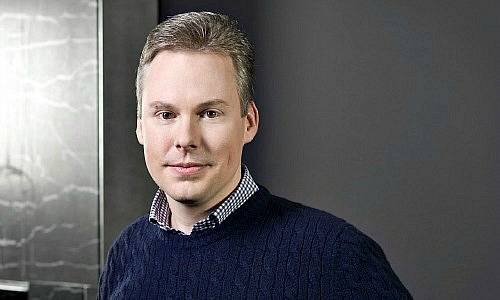

Shares in Leonteq have been falling for months. CEO Jan Schoch isn't worried about it and aims for further growth. He's convinced that investors will return.

Mister Schoch, your CEO Asia is returning to Switzerland, taking over as head of sales and a seat on the board. Who will be in charge in the Far East?

We have already appointed a successor. But we don't yet have the green light from the Monetary Authority of Singapore. The announcement will follow shortly.

Why do you need a sales manager, or to put it differently: who was in charge up till now?

Me. But as we want to diversify the management ressources, we decided to appoint David Schmid, who returned to Switzerland at the beginning of the year. He knows the company very well, having joined back in June 2008.

You significantly extended your presence in Asia over the past years, and you are reaping the benefits with an important share of the result generated in the region. The number of people working in Asia increased to 57 from 41 within a year, an increase of almost 40 percent. Are you going to pause for a while?

No. The development of last year doesn't signify a change of our growth path, in particular in Asia. That market for us has become as big as Europe – and it is expanding at a faster pace, not least because there are fewer financial services companies in Asia developing their own products.

Leonteq hitherto had a cooperation agreement with DBS in Singapore. You cancelled this cooperation. Why?

We plan to run our platform for structured products with a string of partners – in the sense of a multi-issuer platform. We aspire to have about 30 partners by 2020. DBS however insisted on exclusivity, which didn't correspond with our business model. In the autumn, we held talks and now we cancelled the cooperation. The timing is such that the costs remain reasonable.

How do you compensate for the shortfall?

The cooperation with DBS contributed only about 6 percent to the total turnover, which has no bearing on the result as compared with a year earlier. We also are in talks with six to seven other Asian institutions with a view to entering cooperation. A range of partners is important because the Asian market is very fragmented and because of the huge cultural differences. Today we announced a planned partnership with Standard Chartered, an institute that is very strong in Asia and which will distribute structured products through our platform in Hong Kong, Singapore and Switzerland. We also are developing a further cooperation with Maybank of Malaysia. We are currently in talks with a total 22 institutions worldwide.

What about the participation of the Singapore state fund now that you've cancelled the cooperation with DBS?

The Government of Singapore Investment Corporation has indeed helped us with the initial talks with DBS, but wasn't involved in the further development. Two weeks ago, the GIC increased its stake in Leonteq to 3 percent from 2 percent, an important step for a place like Singapore. I can't exclude that this participation will be further developed.

The year has started rather intensively in the markets. What are the effects on Leonteq?

We have started very well despite the turbulence and we are keeping a positive outlook. Our products play an important role for many investors in the current market. In a situation, where shares generally are rather highly priced, with overpriced bonds and negative interest rates in Switzerland and Japan, many investors are looking for high-yield products.

The Leonteq share has been in decline for months and today Thursday dropped as much as 17 percent. Aren't you worried?

The market takes a short-term view. We don't. We are a case of long-term growth. I'm sure that times will change again and investors will be looking for longer-term investment stories. But for sure, the stock market is rather nervous at the moment. The horizon of a great many investor seems to end in one hundred meters instead of on the next continent.