Banks are optimistic that they can both industrialize and digitalize in one go. But an accident caused by a self-driving Tesla on Switzerland’s east-west axis motorway should give them pause, says finews.ch editor Samuel Gerber in an essay for finews.first.

finews.first is a forum for renowned authors specialized on economic and financial topics. The texts are published in both German and English. The contributions appear in cooperation with Pictet, the Geneva-based private bank. The publishers of finews.ch are responsible for the selection.

Thousands of commuters saw the headline in free Swiss newspaper «20 Minuten» this week: «Tesla Driver Causes A1 Motorway Accident Due To Autopilot.» A Tesla driver crashed into a delivery truck, which had come to a standstill, on a busy Swiss motorway after the electric car’s digital system apparently failed. The car’s autopilot, active cruise control and automatic emergency brake all let the driver down.

Filmed by Tesla’s «dashcam», the crash has been viewed hundreds of thousands of times (see video below) after going viral on social media. While it’s not known if any bankers — known to be aficionados of the electric vehicles which have redefined luxury cars — watched the footage, they would be well advised to consider it mandatory viewing.

That’s because what happened on the Q1 motorway is the real-life version of what happens when we blindly place trust in a digitized environment. The fact that the accident happened in a car should be more meaningful for bankers than that it happened at all.

«Bankers Want To Be Like Carmakers»

But first a word on the Swiss banking industry’s buzzword long before digitization came along: industrialization. Faced with rising costs and thinning margins, the process of standardizing what have until now been individually produced services became a must-do in banking. In particular, big banks UBS and Credit Suisse hired large teams with expansive authority to evaluate how to do so, citing similar moves decades ago by manufacturing industries. As finews.ch headlined at the time, «Toyota As A Role Model».

That’s because while role models were needed, financial services literally didn't have any, and had to look to the automotive sector, which automates up to 90 percent of its processes, outsources entire production chains, and sells a standardized offering — impressive for an industry like banking, which is considerably behind with the concept of industrialization. Even white-glove Swiss private bankers who pride themselves on highly personalized service and tailor-made products were taken by the idea of offering only a limited range of performance, service and gadgets, like the car industry.

Banking’s admiration of the car industry persists, with Neue Zuercher Zeitung writing recently on banking costs that financial firms, unlike manufacturers, «are hardly supported by clear and practiced processes.»

«Race Not Won On Factory Floor»

That may be true, but clear and practiced processes are a thing of the past with carmakers too. Automakers and other manufacturing industries aren't concerned about industrialization anymore; they're more focused on what remains of industry.

Carmakers in particular don't face especially rosy prospects: steel and horsepower alone doesn't cut it anymore. And with intelligent, self-driving cars like one being developed by Google increasingly in focus, the race for clients isn’t won on the factory floor, but on a computer. Or to put it another way: the hardware isn’t going to win the day; the software will. But processes driven by software — as illustrated by the A1 motorway crash — can have calamitous consequences, a sign that even the much-vaunted carmakers are stretched to their limits with digitization.

This should all give bankers pause for thought because unlike Tesla and Co, financial firms haven't actually managed to industrialize yet. The next step – digitization – ups the ante once again for banks. Remarkably, considering what is at stake, the financial services industry is almost blindly optimistic.

«Quantum Leap Made To Look Like A Cakewalk»

Another example of this blind optimism is blockchain technology, which has attracted a host of former bankers and which numerous experts predict will upend finance.

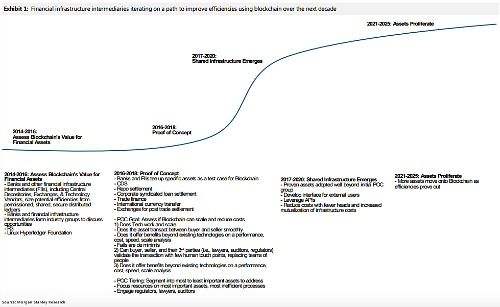

U.S. bank Morgan Stanley set a roadmap for the potentially disruptive technology’s introduction in a recent study (see graphic below). Morgan Stanley’s experts see the current proof-of-concept phase as ending by 2018, with the next phase of building a blockchain infrastructure by 2020. The bank predicts that through 2025, more and more market volume will move to the new system «as efficiencies prove out.»

Of the ten challenges that Morgan Stanley identifies during this period, only two are explicitly declared as risks. What is effectively a quantum leap of technology is presented as a cakewalk. But one doesn't have to dig very far to find an opposing view. Insurance firm Swiss Re expects «considerable» risks from fintech, blockchain, and in the area of data security — not exactly a walk in the park.

«Even The Federal Reserve Has to Defend Itself Against Cyberattacks»

But the status quo shows how vulnerable «traditional» digital systems are. One only has to look at hacking attempts on Swift, without which worldwide payment systems would come to a virtual standstill. Even the U.S. powerful central bank, the Federal Reserve, fends off several cyberattacks a day.

This is not only no cakewalk – this is war.

Reason enough then for bankers, to rethink how they want to position themselves considering these future trends. Data security is just as important to banks as driver safety is for carmakers. Just getting in, buckling up and see where the journey takes you — in a space with zero tolerance for mistakes, this approach will backfire badly, and banks will be held accountable.

The unfortunate driver in the Tesla motorway crash has already come to this realization after the accident, which thankfully amounted to nothing more than a fender bender. «Of course I am responsible, and I should have reacted sooner. But if the car works properly 1000 times in a row, you trust it the next time too.»

Samuel Gerber is part of finews.ch's editorial team.

Previous contributions: Rudi Bogni, Adriano B. Lucatelli, Peter Kurer (twice), Oliver Berger, Rolf Banz, Dieter Ruloff, Samuel Gerber, Werner Vogt, Claude Baumann, Walter Wittmann, Albert Steck, Alfred Mettler, Peter Hody, Robert Holzach, Thorsten Polleit, Craig Murray, David Zollinger, Arthur Bolliger and Beat Kappeler, Chris Rowe, Stefan Gerlach, and Marc Lussy.