Australia and Singapore in Fintech Pact

The Monetary Authority of Singapore and the Australian Securities and Investments Commission have agreed to help financial technology businesses explore opportunities in their respective markets.

The agreement will enable innovative FinTech companies in Singapore and Australia to establish initial discussions in each other’s market faster and receive advice on required licences, helping to reduce regulatory uncertainty and potentially, time to market.

Others to Join?

finews.asia reported earlier that Sopnendu Mohanty, Chief FinTech Officer, Monetary Authority of Singapore, (MAS) was travelling to Sydney to host discussions and a networking event with Stone & Chalk, an independent, and strongly supported, not-for-profit Australian fintech hub.

To qualify for the support offered by the agreement, fintech businesses will need to meet the eligibility criteria of their home regulator. Once referred by the regulator, and ahead of applying for licence to operate in the new market, a dedicated team or contact person will help them to understand the regulatory framework in the market they wish to join, and how it applies to them.

Could we soon see the Hong Kong authorities also get on board as they try to close the fintech gap with their closest rivals.

Crossing Borders

The newly inked agreement between the proactive regulators is expected to create opportunities for FinTech businesses from Singapore and Australia to grow and expand into each other’s markets.

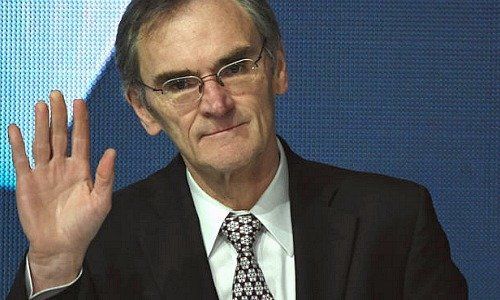

«We recognised that innovation in financial services isn’t confined by national borders. The Australian Securities and Investments Commission (ASIC) is committed to encouraging innovation that has the potential to benefit financial consumers and investors. We believe this agreement with the MAS will help break down barriers to entry both here and in Singapore,» said Greg Medcraft, Chairman, ASIC.

ASIC and MAS have also committed to exploring joint innovation projects together, and to share information on emerging market trends and their impact on regulation.