Swiss Banks Said to Work on Abu Dhabi Merger

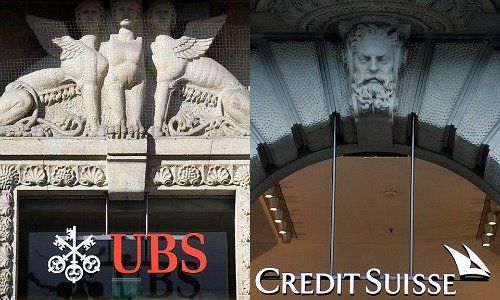

Credit Suisse and UBS are advising on the potential merger of Abu Dhabi’s two largest banks, according to reports in the industry.

National Bank of Abu Dhabi (NBAD) and First Gulf Bank (FGB) have announced that they are considering a merger, which would form an entity with approximately $170 billion in assets.

According to people with knowledge of the matter, Credit Suisse is advising National Bank of Abu Dhabi on the combination while UBS is working with First Gulf Bank. Saad Benani is head of investment banking for Credit Suisse in the region, while Alberto Palombi is his counterpart at UBS, writes news agency «Bloomberg».

Credit Suisse, UBS, NBAD, and FGB so far declined to comment.

Reduced Investment Banking Operations

A working group of senior executives from NBAD and FGB is reviewing all aspects of a deal, according to a filing to the Abu Dhabi stock exchange on Sunday. «Bloomberg» was first to report the two banks were considering a potential merger on June 16.

Credit Suisse and UBS were among banks that reduced investment banking operations in the Middle East as deal-making slowed after the global financial crisis. Credit Suisse plans to shrink parts of its investment bank and focus on growth in Asia and wealth management.